Weekly Wealth Report

Issue 185, Weekly Wealth Newsletter: 10th Mar 2025 -17th Mar 2025

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Will this Relief Rally Sustain?

Download this NewsLetter as a PDF

Indian equity market shows promise as the Nifty 50 ends a three-week slide, closing nearly 2% higher. Key factors include positive macroeconomic indicators, a drop in the dollar index, and RBI’s liquidity support.

Sensex broke 19 days falling market, Stock Market witnessed strong buying from DII’s. Few Sectors valuations are attractive and business are also strong fundamentals.

Going by the past data, March is typically the best time for Indian Equities. Brokers are betting big on revival of the stock market in March. Analysing the data for the last 10 years, best nifty return in the month of march was 11% in 2016.

Most of the bad sentiment news such as ongoing tariff wars between US, China, Mexico and Canada have been factored in. Most sectoral indices turned positive except Auto, IT and Pvt Banks.

Rupee climbs almost 1%, marking its strongest rally in over 2 years on likely RBI intervention. Sharp Rupee gains against USD provided a boost to investor sentiment. Rupee emerged as Asia’s top performer, while other emerging market currencies saw losses.

Dip in US bond yield: “Even though there was a rise in the US treasury yields on Wednesday, the asset has witnessed some selling in the recent sessions after the profit-booking trigger in the US dollar.

Market falls are temporary, but wealth creation is permanent. Stay Invested, Stay Disciplined!”

Happy Investing!

Successful investment strategy requires regular reviewing and investor should buy funds at lower levels you can always reach us @ 78100 79946 for your portfolio review and rebalance

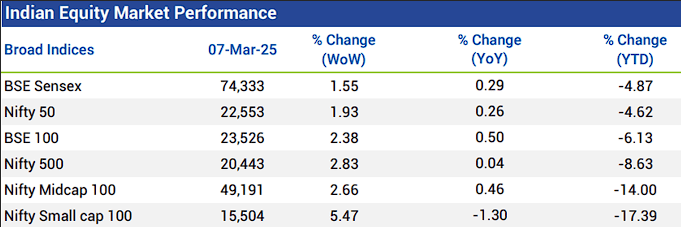

Weekly Market Pulse

Domestic equity markets rose after witnessing fall for three consecutive weeks as key benchmark indices BSE Sensex and Nifty 50 fell 1.55% and 1.93%, respectively. The rally was broad-based as the mid-cap segment and the small-cap segment both closed the week in green.

Domestic equity markets rallied after reports emerged that the U.S. President will “probably” announce a deal to reduce tariffs on Canada and Mexico.

Sentiment was boosted after the U.S. administration has announced a one-month delay on tariffs affecting cars entering the U.S. from Canada and Mexico, raising hopes for negotiations

Gains were extended following the domestic services PMI data that expanded at an accelerated pace in Feb 2025

Additionally, a drop in the U.S. dollar index further extended the gains. However, persistent foreign capital outflows continue to pose a significant challenge to the domestic equity markets.

Mutual Fund Corner

Axis Balanced Advantage Fund

A dynamic asset allocation can help investors overcome volatility in Investors Portfolio by dynamically adjusting the Equity Allocation.

Axis Balanced Advantage fund follows a 5-factor approach to determine equity exposure while rebalancing.

All 5 variables are given importance while computing the net long exposure. While few factors are quantifiable like valuation, earnings momentum; there are factors like geo-political scenarios which consider the events and market expectations that impact the trend in the stock market.

The fund endeavours to generate capital appreciation via equity exposure and to generate income by investing in Fixed Income securities

Suitable for Investors looking for a solution which dynamically adjusts equity exposure and to participate decently in market rallies

The Fund is ideal for investors who have an investment horizon of 5 years.

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 78100 79946 )

Mutual Fund Course

All you want to learn about Mutual Funds

Kickstart your Investment Journey of 2025 from here

What You will Learn:

1. A-Z of Mutual Funds

2. Master the Art of SIP’s

3. Build Wealth Like a Pro

4. Recorded session contains 8 Chapters in Tamil Language

5. Lifetime Access

My First 1 Crore Club

Still Wondering how a salaried person/professionals can make 1cr?

Why do you have to join this Community?

• Having money but still doesn’t know how & where to invest?

• Selecting wrong Stocks?

• Selecting wrong mutual funds?

• Invested in all possible ways still money haven’t doubled?

Join our First 1cr Club Webinar by payingjust 499/-

Stock Simplified Course

All you want to learn about Stock Market

Kickstart your Investment Journey of 2025 from here

Key Highlights:

1. Key entry and exit points of the stock market

2. 6-point filter to select a high-performing stock

3. Learn macro-economic trends in stock picking

This Week Media Publications

My Recent Article in Nanayam Vikatan. What is Information Ratio and how it will be useful to choose Best Mutual Funds?

My Book Publications

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.