Weekly Wealth Report

8th July 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 150, Weekly Wealth Newsletter: 8th July 2024 – 15th July 2024

Dear Readers

I am very excited and happy to present the

150th Edition of this Newsletter.

3 Years back, I envisaged to present Newsletter on Equity and Financial Markets with Indian and Global Perspectives on a weekly basis and hence this Weekly Wealth Letter.

Our dream to make investing simpler, profitable, and accessible to everyone and this is one simple step to educate Investors and make investing an easy process

Will Sensex Hit 1,60,000 by 2029?

“Sensex has doubled every 5 years, target 1,60,000 for Sensex by 2029. Market can double in the next 5 years with a 15% CAGR, this is the happiest moment of my life,” he told CNBC-TV18 in an interview.

The Benchmark S&P BSE 30 index opened above 80,000 on Thursday, it had briefly crossed the same on Wednesday too. The Sensex had crossed the 70,000 mark on December 11,2023.

The gain from 70k to 80k has been achieved in the shortest span of time. The reasons for gain are being attributed to monsoons, softening of US bond yields, and positive FPI flows in June.

Mr Raamdeo Agarwal also said in four years, India might become a 10 trillion market.”

Don’t miss out on this opportunity to ride this wave.

Call us @ 78100 79946 to start your Investments

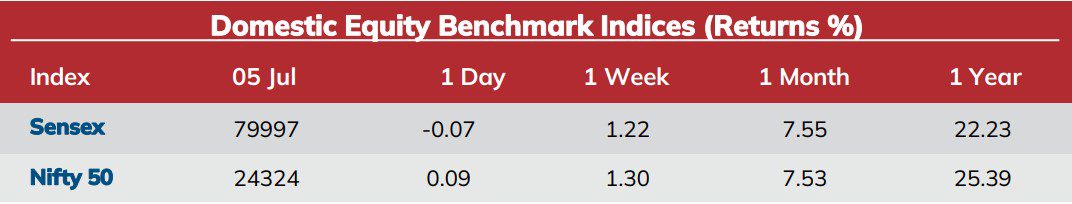

Weekly Market Update

-

- The benchmark Sensex on Wednesday breached the 80,000 for the first time during intraday trading, completing an impressive ascent of nearly 10,000 points from the Lok Sabha election results-day low of 70,234 on June 4.

-

- The BSE SENSEX (+6.9%) rose in June 2024, in line with the NSE NIFTY index. BSE Mid-cap and Small-cap indices outperformed the BSE Sensex, with growths of (+7.7%) and (-10.3%) respectively.

-

- Sector-wise, Infotech, Teck and Realty were the top 3 performers over the month, June 2024 clocking (+11.3%), (+9.5%), and (+8.2%), respectively. All of BSE’s 13 sectoral indices ended the month, June 2024 in green.

-

- India’s Manufacturing Purchasing Managers’ Index (PMI) in June 2024 rose to a two-month high at 58.3 (vs 57.5 in May 2024), remaining in expansion zone for the 35th straight month driven by manufacturing employment accelerating and improvement in new order intakes.

-

- India’s forex reserves dropped $1.713 bn to $651.997 bn for the week ended June 28.

- Finance Minister Nirmala Sitharaman wrapped up consultations with industry and social sector representatives ahead of presenting her seventh Union Budget on July 23.

Mutual Fund Corner

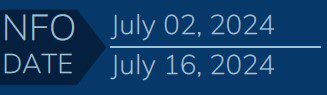

ICICI Pru Energy Opportunity Fund

An open ended High Aggressive Thematic NFO which helps investors to invests in instruments of companies engaged in and/or expected to benefit from the growth in traditional & new energy sectors & allied business activities

Investments will go into sectors like Power Ancillaries, Oil Value Chain, Green Energy, Gas Value Chain and Power Value Chain

This fund will benchmark Indian Energy TRI Index

This is a Large Cap Biased scheme which invests in the above companies with long term basis

Stock of the Week

BASF India

CMP – 5460

Target – 6499 ( In 12 – 18 Month’s Time Frame)

For your Equity recommendation – open a De Mat account with Angel Broking with this link

https://app.aliceblueonline.com/openAccount.aspx?C=SSP03

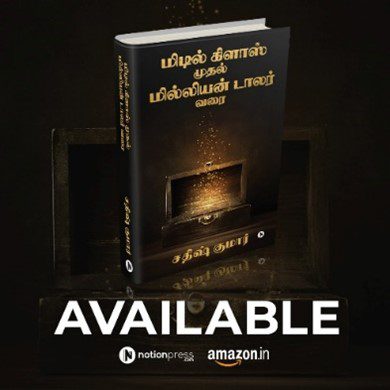

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Click here to purchase the book from Amazon

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.