Weekly Wealth Report

20th May 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 143, Weekly Wealth Newsletter: 20th May 2024 – 27th May 2024

Why SEBI Rings Alarm Bell over Futures & Options?

Recently our Finance Minister Shri Nirmala Sitharaman flagged the growing risks over Future & Options Trading over Retail Investors.

F&O is a derivative method where investors can buy or sell a contract of a stock with a predetermined price.

What is concerning about F&O Trading is many investors flooded into stock market to make quick money with this option.

SEBI came out with a statistic that overwhelming 89% of investors lose their money in F&O, that means only 10 are making money out of Futures & Option Trading.

Also there are many Scams and Fake Apps which are using this as a opportunity to lure the small investors with unreasonable profits. They also use fake screenshots and documents to attract retail investors into Futures & Option Trading

It is best to avoid such speculative nature investments and Stick to long term fundamental investments like Mutual Funds for Small Investors.

The greediness from the investors to make more money from stock markets kills the common sense.

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

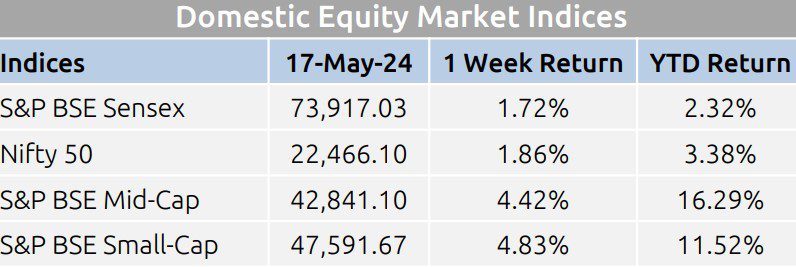

Weekly Market Update

- Domestic equity markets rose after witnessing fall in previous week as key benchmark indices S&P BSE Sensex and Nifty 50 rose 1.72% and 1.86%, respectively.

- The rally was broad based as the mid-cap segment and the smallcap segment both closed the week in green.

- Domestic equity markets rose during the week following an ease in domestic retail inflation data, which fell to 11- month low of 4.83% on an annual basis in Apr 2024

- On the BSE sectoral front, S&P BSE Capital Goods soared 8.70% following robust revenue and profit traction from capital goods firms in Q4FY24.

- The nation’s robust infrastructure capex is reflected in recent capital goods firm results, which also indicate strong order flows.

- The consumer price index-based inflation eased slightly to 11-month low of 4.83% YoY in Apr 2024 compared to 4.85% in Mar 2024. The number remained within the RBI’s upper tolerance level for the eighth consecutive month

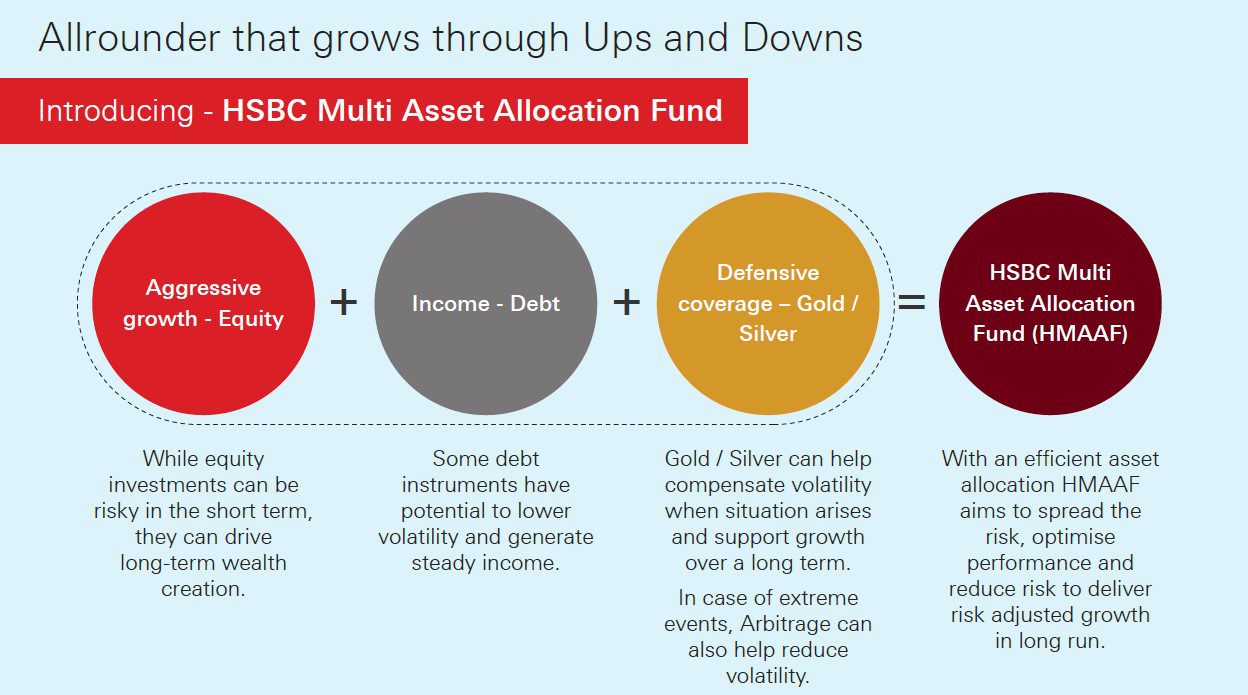

Mutual Fund Corner

HSBC Multi Asset Fund

Every portfolio needs different asset classes that can combine to provide return potential while adjusting risk. Choose a fund that invests in equity for growth potential while debt and Gold / Silver can help to balance risks in volatile market conditions.

Multi Asset Funds are best pick for Risk Adjusted Performances

Stock of the Week

Axis Bank

CMP – 1143

Target – 1399 ( In 12 – 18 Month’s Time Frame)

For your Equity recommendation – open a De Mat account with Angel Broking with this link

https://app.aliceblueonline.com/openAccount.aspx?C=SSP03

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Click here to purchase the book from Amazon

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.