Weekly Wealth Report

Issue 171, Weekly Wealth Newsletter: 2nd dec 2024 – 9th dec 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Where will Dalal Street

go in Dec 2024?

Download this NewsLetter as a PDF

Equity markets saw a downturn in November with various events impacting them including the US presidential elections and selling off by the foreign institutional investors (FIIs) last month. This led to increased volatility in the markets.

In an ever-evolving financial world, all eyes on Dec 2024. Historically December is always a cheerful month. In the last 20 years, December has given positive returns for 15 years.

With Japanese Yen and Chinese Yuan gaining strength against dollar, the currency index is also an important cue to watch out for in Dec 2024.

With economic indicators, RBI Monetary policy is scheduled on Dec 6th 2024. The Reserve Bank of India (RBI) likely to hold its previous repo rate at 6.5 per cent.

The 60 days Cease fire of Iran and Isreal will stabilise the oil prices and expect a positive outcome for upcoming OPEC Meeting on 5th Dec 2024.

Dec 2024 is a busy month for IPO Activity, 5 IPO’s are scheduled. Starting with Vishal Mega Mart, International Gemological Institute, DAM Capital, Avanse Financial Services and Sai Life Sciences.

December is usually a low activity month for equity markets, especially from foreign investors. With major events like elections and the earnings season out of the way, the focus will be on the pace of revival of consumer demand, especially post the festive season.

Flexi cap and aggressive hybrid funds could be considered for lumpsum investments. Small cap funds may be considered for SIP investments.

Equity investors should not be overly worried about the monthly or quarterly market movements as it may lead to suboptimal decision making that can have a meaningful impact on the long-term performance of their investments.

The Indian economy is in a great shape. Demand and government spending are increasing. We just need to get used to the introduction of policies by the new US government. We may not see the euphoria of the last 2-3 years, but we may still compound at a reasonable rate.

These events will set a stage for Calendar Year 2025.

Successful investment strategy requires regular reviewing and investor should buy funds at lower levels you can always reach us @ 78100 79946 for your portfolio review and rebalance

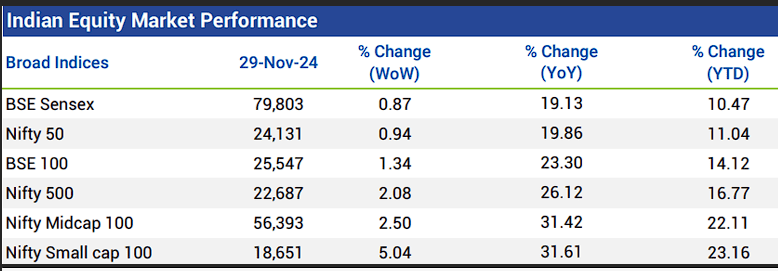

Weekly Market Pulse

Domestic equity markets rose for the second consecutive week as key benchmark indices BSE Sensex and Nifty 50 rose 0.87% and 0.94%, respectively. The rally was broad-based as the mid-cap segment and the small-cap segment both closed the week in green

Domestic equity markets rose after the Maharashtra state’s current coalition government, led by the ruling party at the Centre, achieved a notable triumph in the state assembly election which raised expectations for an increased government spending and policy continuity with emphasis on infrastructure and capex.

Sentiment improved after the Indian conglomerate clarified that it was not facing any charges related to the Foreign Corrupt Practices Act in relation to the issues set out by the U.S. Department of Justice or the civil complaint by the U.S. Securities and Exchange Commission.

On the BSE sectoral front, BSE capital goods and PSU surged 4.87% and 3.70%, respectively, driven by an optimistic outlook for the sectors on the back of hopes of a capex push following a remarkable victory of current coalition government in Maharashtra led by the ruling party at the Centre in the assembly election.

Mutual Fund Corner

Edelweiss Business Cycle Fund

The Edelweiss Business Cycle Fund evaluates businesses combining Momentum with Value ( PE, PB, EBITDA, Div Yield ) Quality ( ROE, ROCE) and Growth ( EPS, Operating Margin )

This fund invest in a factor-based approach to capture trends in business cycles.

Why to consider Edelweiss Business Cycle Fund?

- Filter from top 300 stocks by market cap for investable universe.

- Market-cap bias – Aims to maintain equal allocation between large caps and mid/small caps.

- Key factors used in the model – Growth, Quality, Value & Momentum.

- Construct portfolio of 60 stocks across large cap and mid/small cap universe.

- Select top ranked stocks from each factor combination based on their scores (Value+Momentum; Growth+Momentum; Quality+Momentum)

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 78100 79946 )

Stock of the Week

Apollo Hospitals

CMP – 6829

Target – 7999 ( In 12 – 18 Month’s Time Frame)

Apollo Hospitals was established in 1983 by Dr. Prathap C Reddy, renowned architect of modern healthcare in India. As the nation’s first corporate hospital, Apollo Hospitals is acclaimed for pioneering the private healthcare revolution in the country.

Healthy long term growth as Operating profit has grown by an annual rate 20.59%

With a growth in Net Profit of 28.29%, the company declared Very Positive results in Sep 24

Stock is technically in a Mildly Bullish range, Multiple factors for the stock are Bullish like MACD, KST and OBV

With ROCE of 16.9, it has a Fair valuation with a 8.6 Enterprise value to Capital Employed

High Institutional participation of 65%

The stock is trading at a discount compared to its average historical valuations

For your Equity Recommendation, Pls call us 78100 79946

This Week Media Publications

This week at Nanayam Vikatan, How a SWP can support you as your Monthly Income?

Read this article by clicking down below

My Book Publications

My First 1 Crore Club

Are you still dreaming to achieve a net worth of ₹1 crore?

Still dreaming how to make 1crore?

Still Wondering how a salaried person/professionals can make 1cr?

To all the questions in your mind here is the potential ways to build it through Mutual Funds, Stocks and Much More…

Still dreaming how to make 1crore?

Still Wondering how a salaried person/professionals can make 1cr?

To all the questions in your mind here is the potential ways to build it through Mutual Funds, Stocks and Much More…

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.