The difference between winning and losing mutual funds could

possibly stretch to Rs 2.5 crore in 20 years.

I’m talking only about a small Rs 50,000 monthly SIP @ 15% over 20 Years. The difference between 12% of returns and 15% of returns

over 20 year period is 2.5 Crore.

- What if the wrong funds are picked?

- What if, you pick the portfolio construction wrongly?

- What if, you do not review your funds regularly?

- What if, you do not understand the Micro and Macro Fundamentals?

And how much damage it could possibly make to your financial

fortunes in the long term.

Before putting even a single rupee in mutual funds, I strongly urge

you to have a Strong & Fool Proof Investment Process

If you think, you need any help in investing, reach us

@ 63795 18807

Weekly Market Update

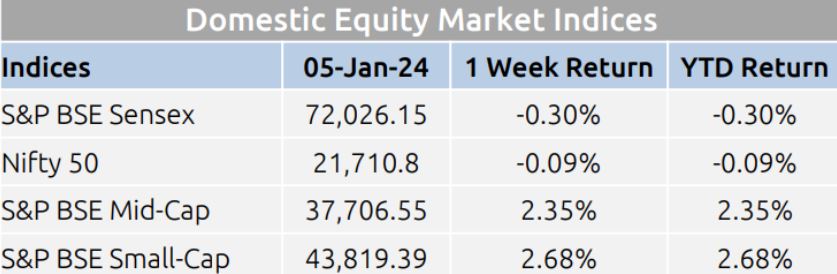

- Domestic equity markets fell after witnessing a rise in the previous week as key benchmark indices S&P BSE Sensex and Nifty 50 fell 0.30% and 0.09% respectively.

- However, the midcap segment and the small-cap segment closed the week in green with significant gains.

- Domestic equity markets finished the first week of the New Year with marginal losses on concerns over escalating geopolitical tensions in the middle east.

- Sentiments were weighed following a significant rise in global crude oil prices due to conflict in the Red sea that threatened a disruption in global trade and crude oil supplies. Weak data from China’s manufacturing sector of Dec 2023 extended the losses further.

- On the BSE sectoral front, S&P BSE Realty rose 7.91% as promising demand in the residential category, bolstered by healthy housing loan disbursement data released by banks, led to a significant increase in purchasing in the real estate sector

- S&P BSE Healthcare rose 3.27% due to several factors like, the strong performance in branded markets, lower raw material costs, increased market share in recently launched products, and improved performance in the U.S. generics market.

Mutual Fund Corner

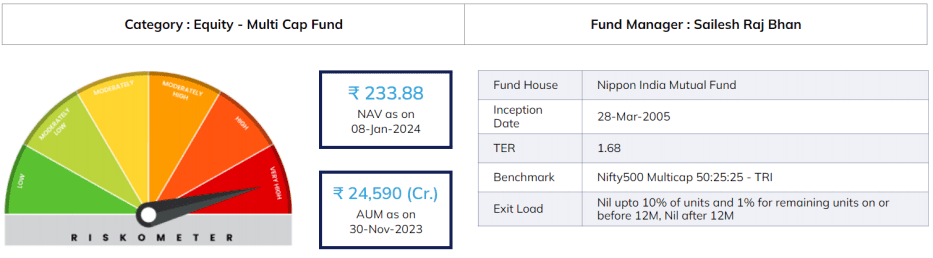

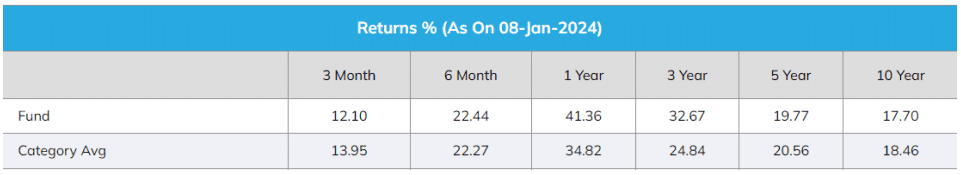

Nippon Multi Cap Fund

- The primary investment objective of the scheme is to seek to generate capital appreciation & provide long term growth opportunities by investing in a portfolio constituted of equity securities & Equity related securities and the secondary objective is to generate consistent returns by investing in debt and money market securities.

- The fund has 98.37% investment in domestic equities of which 36% is in Large Cap stocks, 21.97% is in Mid Cap stocks, 23.75% in Small Cap stocks.

- To invest in SIP & in Mutual Funds Click the link and start your investments instantly

http://www.assetplus.in/partner/sathishkumar

: What if I say, picking the wrong mutual fundsCould Cost You 1 Crore?

Stock of the Week

Persistent Systems

CMP – 576

Target – 670 ( In 6 – 12 Months Time Frame)

- EID Parry is engaged in Sugar, Nutraceuticals and ethanol production. It also has a significant presence in the Farm Inputs business including Bio pesticides through its subsidiary, Coromandel International Limited

- Strong ability to service debt as the company has a low Debt to EBITDA ratio of 1.09 times

- Healthy long term growth as Net Sales has grown by an annual rate of 15.27% and Operating profit at 20.09%

- ROCE(HY) Highest at 38.88 %

- With ROE of 14.9, it has a Very Attractive valuation with a 1.5 Price to Book Value

- OPERATING PROFIT TO INTEREST(Q) Highest at 14.24 times

- The stock is trading at a discount compared to its average historical valuations

For your Equity recommendation – open a De Mat account with Angel Broking with this link

This News letter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689 You can also connect with us investments@sathishspeaks.com Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme related documents carefully. Past performance of the mutual fund is not necessarily indicative for future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purpose only and contains information, opinion, material obtained from reliable sources and every effort has been made to avoid errors and omissions and is not to be construed as an advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means are prohibited.