Weekly Wealth Report

29nd July 2024 – 4th August 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 153, Weekly Wealth Newsletter

Mutual Funds are very popular investment option even for small retailers to participate in Capital Markets. With the Mutual Funds Assets crossed 60 Lakh Crore, how the 2024 Budget changed the taxes on these financial Assets?

Debt Schemes

There are no changes for Debt Mutual Fund taxation on this proposed budget. Investors will have to pay capital gains on these funds in line with their income slabs irrespective of Holding Periods

Equity Schemes

Funds with Equity with more than 65% are classified as equity Funds. All funds including Balance Advantage, few Equity Saving funds are also coming under Equity Mutual funds. The gains from the sale of any of these funds attracts STCG is 20% and LTCG is 12.5%

Gold and Other Fund of Funds ( FoF )

Fund of Funds, Mutual funds invest in other schemes (Including International Funds) earlier they were treated as debt instruments. Now with new budget, if you held the scheme for 24 Months, the LTCG will be charged for 12.5% and for holding period lesser than that will be considered as STCG and will attract tax as slab rate

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

Weekly Market Pulse

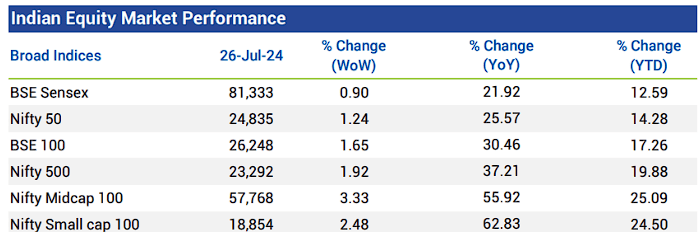

- Domestic equity markets rose for the eighth consecutive week as key benchmark indices BSE Sensex and Nifty 50 rose 0.90% and 1.24%, respectively. The rally was broad-based as the mid-cap segment and the small-cap segment closed the week in green.

- Domestic equity markets started the week on weaker note as investors reacted to the Union Budget announcements, particularly the changes in capital gains tax.

- Losses were extended following uncertainty over rate cuts and news flow around the U.S. Presidential elections. Further, lower-than-expected earnings growth from domestic major banks of Q1FY25 kept the markets under pressure

- However, the trend reversed, and markets rallied to fresh high buoyed by the government’s commitment to improving consumption and bridging the gap for energy transition in the Budget

- Sentiments were boosted following the faster-than-expected U.S. GDP growth data in Q2 2024 along with slower PCE price index growth in Jun 2024, which raised optimism among the investors about rate cuts by the U.S. Fed by the end of the year.

Mutual Fund Corner

Invesco India Manufacturing Fund NFO

India’s economy is geared up to reach US$ 9 trillion by 2034, and the manufacturing sector will drive this next wave of growth.

What makes India a preferred manufacturing destination?

- Strong Domestic Demand

- Economies of Scale due to Volume Growth

- Export Potential

- Improving Access to Capital and Funds

- Low Labour Costs and abundant Talent Pool

- Government Reforms and Push for Manufacturing

Key factors used in the model – Growth, Quality, Value & Momentum.

The model helps in constructing a portfolio of 50 – 60 Stocks that are doing well in Modern Age Manufacturing.

To invest in SIP & in Mutual Funds Click the link and start your investmentsinstantly ( You can also call us @ 7810079946 )

Stock of the Week

CDSL

CMP – 2447

Target – 2999 ( In 12 – 18 Month’s Time Frame)

- Central Depository Services Limited is a Market Infrastructure Institution (MII), part of the capital market structure, providing services to all market participants – exchanges, clearing corporations, depository participants (DPs), issuers and investors

- Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 21.14%

- With a growth in Net Profit of 98.1%, the company declared Outstanding results in Mar 24

- High Institutional Holdings at 38.91%

- Healthy long term growth as Net Sales has grown by an annual rate of 32.84% and Operating profit at 21.19%

- The company has declared positive results for the last 3 consecutive quarters

- PAT(Q) At Rs 129.26 cr has Grown at 104.8 %

- NET SALES(Q) Highest at Rs 240.78 cr

For your Equity recommendation – open a De Mat account with Angel Broking with this link

This week Media Publications

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Click here to purchase the book from Amazon

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.