Weekly Wealth Report

Issue 186, Weekly Wealth Newsletter: 17th Mar 2025 -24th Mar 2025

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Sensex to Cross 1,05,000 By Dec 2025?

Download this NewsLetter as a PDF

Despite the recent uncertainties and fall in the stock market for last 5 Months. Despite the challenges like Trade wars, Tariff Rise, Dollar Strengthening will Sensex Hit 1,05,000 by Dec 2025?

Morgan Stanley have not changed their guidance despite all the above challenges in the world of Stock Investing. They feel there is 30% probability of Sensex hitting 1,05,000 by Dec 2025.

Morgan Stanley Analysts and Economists led by Ridhan Desai, mentioned that Indian Earnings are turning up positive and India is a stock picking market, where the valuations are attractive after covid pandemic levels.

India’s low share of marketing exports and high services exports are saviour in the world of High Tariffs. RBI Rate Cuts, Strong Budget spending with Tax exemptions on this budget are positive developments since early Feb 2025 are the sentiment indictor and making India is in strong buying territory.

What can derail this bull run up will be Trade and Tariff policy from US, USD Vs Indian Rupee Movements, and any other Geo Political Interventions.

Successful investment strategy requires regular reviewing and investor should buy funds at lower levels you can always reach us @ 78100 79946 for your portfolio review and rebalance

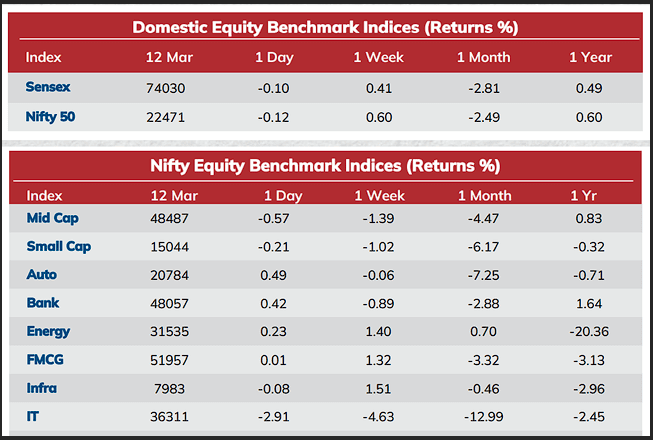

Weekly Market Pulse

Retail Inflation cools down to a seven-month low in Feb as food prices eased. This will enable RBI to lower the Interest rates in April 2025.

India annual inflation rate eased to 3.61% in February 2025 from the downwardly revised 4.26% in January 2025.

Industrial Growth improves to 5% in Jan as manufacturing rebounds.

Indian equity benchmarks ended lower this week, as IT stocks fell on US growth concerns while uncertainty about tariffs persisted.

Moody’s Ratings said India’s real Gross Domestic Product (GDP) growth is projected to exceed 6.5% in the fiscal year ending March 2026.

Mutual Fund Corner

Edelweiss Balanced Advantage Fund

The fund dynamically changes asset allocation across equity, debt, cash and derivatives (including hedges), based on valuation cycles

The Fund manager will increase the exposure to equity when market valuations are attractive and will prune the equity exposure by increasing cash or debt exposure and/or through hedging when equity markets get expensive or experience volatility.

Allocation to equities and debt & money market instruments can be in the range of 0% – 100%.

Asset allocation is determined based on proprietary model combining valuation parameters like P/E & P/B along with the yield gap to determine net equity allocation.

The model may use qualitative overlay of fund management team from time to time to arrive at final equity allocation

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 78100 79946 )

Mutual Fund Course

All you want to learn about Mutual Funds

Kickstart your Investment Journey of 2025 from here

What You will Learn:

1. A-Z of Mutual Funds

2. Master the Art of SIP’s

3. Build Wealth Like a Pro

4. Recorded session contains 8 Chapters in Tamil Language

5. Lifetime Access

My First 1 Crore Club

Still Wondering how a salaried person/professionals can make 1cr?

Why do you have to join this Community?

• Having money but still doesn’t know how & where to invest?

• Selecting wrong Stocks?

• Selecting wrong mutual funds?

• Invested in all possible ways still money haven’t doubled?

Join our First 1cr Club Webinar by payingjust 499/-

Stock Simplified Course

All you want to learn about Stock Market

Kickstart your Investment Journey of 2025 from here

Key Highlights:

1. Key entry and exit points of the stock market

2. 6-point filter to select a high-performing stock

3. Learn macro-economic trends in stock picking

This Week Media Publications

My Recent Article in Nanayam Vikatan. Growth Vs Dividend Stocks, which is better for your Portfolio?

My Book Publications

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.