Weekly Wealth Report

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 144, Weekly Wealth Newsletter: 27th May 2024 – 3rd June 2024

Sensex Hits all time high of 75,000. Are you riding this wave?

Stock Market is offering investment horizons for Small & Retail investors and for High Net worth Individuals.

The Surge in the Stock Marker reflects strong investor confidence and positive sentiment, it’s a indicator of robust economic growth and thriving business environment

As the market scales new heights, it opens plethora of opportunities to make returns from Equity as an Asset Allocation

who precisely knows the future? But there is a good probability that the equity market's 15% compounding of the last 45 years may well sustain into the next 5 years. Stay invested, so that you don't miss out on this ultimate compounding machine called Sensex.

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

Weekly Market Update

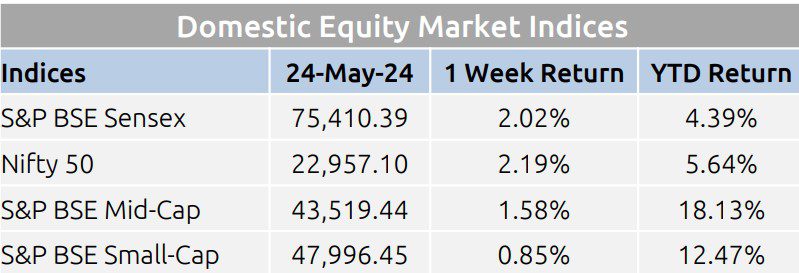

- Domestic equity markets rose for the second consecutive week as key benchmark indices S&P BSE Sensex and Nifty 50 rose 2.02% and 2.19%, respectively

- The rally was broad based as the mid-cap segment and the small cap segment both closed the week in green.

- Domestic equity markets rose during the week after the RBI approved a massive, all-time high surplus transfer of around Rs. 2.11 lakh crore for FY24, boosting government revenues and supporting the fiscal deficit target.

- S&P BSE PSU rose 4.61% on expectation of political stability in the Central government after the ongoing general election outcome.

- On the BSE sectoral front, S&P BSE Capital Goods surged 5.95% following good Q4 results with decent revenue and profit growth. Gains were extended, led by an election results related rally, due to the strong prospects for the sector.

- The RBI approved a dividend of Rs. 2.11 lakh crore for the Central government for FY24, which is approximately 141% more than the Rs. 87,416 crore paid out in FY23.

- The preliminary services PMI rose to a four-month high of 61.4 in May 2024 from 60.8 in Apr 2024 and preliminary manufacturing PMI slightly dipped to 58.4 in May 2024 from 58.8 in Apr 2024.

Mutual Fund Corner

HSBC Multi Asset Fund

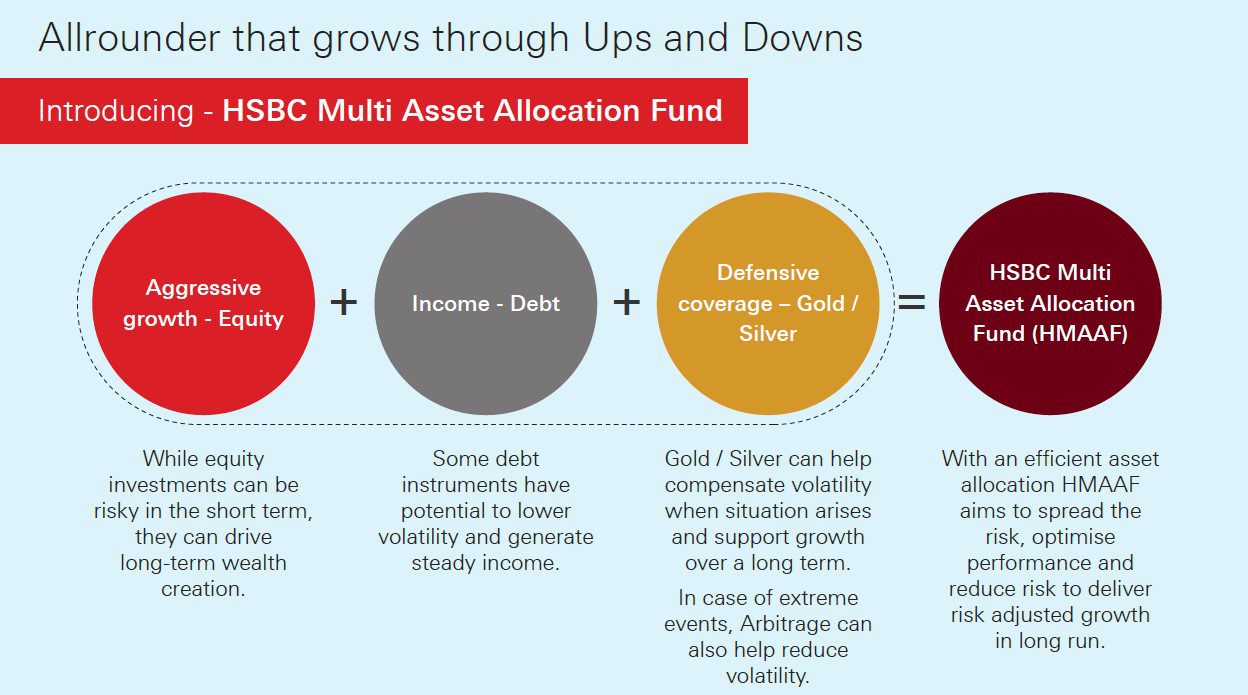

Every portfolio needs different asset classes that can combine to provide return potential while adjusting risk. Choose a fund that invests in equity for growth potential while debt and Gold / Silver can help to balance risks in volatile market conditions.

Multi Asset Funds are best pick for Risk Adjusted Performances

Stock of the Week

CDSL

CMP – 2121

Target – 2599 ( In 12 – 18 Month’s Time Frame)

For your Equity recommendation – open a De Mat account with Angel Broking with this link

https://app.aliceblueonline.com/openAccount.aspx?C=SSP03

This week Media Publications

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Click here to purchase the book from Amazon

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.