Weekly Wealth Report

15th July 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 151, Weekly Wealth Newsletter: 15th July 2024 – 22nd July 2024

Sensex at 80,000! How to Approach Equity Mutual Funds Now?

This is stupendous for the Indian equity market amid rising geopolitical tensions and various other key risks, such as tightening global financial conditions and capital outflows, among others.

India is viewed as a "bright spot" the fastest growing economy major economy with several structural reforms being rolled out by the current dispensation, a significant rise in government spending for sustainable economic growth, the sovereign rating outlook has been recently upgraded to 'positive' from stable, and the country is enjoying a favourable demographic dividend.

National Stock Exchange (NSE) Report cites that higher-than-expected GDP growth and strong corporate earnings have boosted investor confidence.

However, as we scale new highs, it is also important to recognise that valuations are not cheap. Relative to many of their global peers, Indian equities are trading at a noticeable premium.

At present, India's market capitalisation-to-GDP ratio, famously called the Buffett indicator (named after legendary investor Warren Buffett), is in the 'modestly overvalued' zone.

Hence, approach the equity with prudence by devising a sensible strategy instead of investing in an ad hoc manner or mindlessly going gung-ho and skewing the portfolio to Small caps and Mid caps.

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

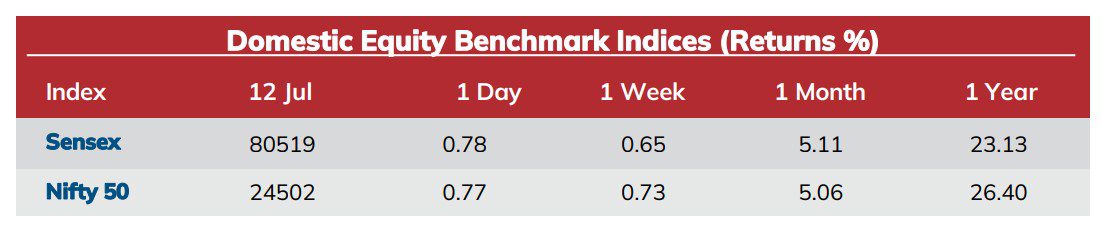

Weekly Market Update

-

- Indian equities closed at record high on Friday, buoyed by IT stocks, after a major domestic software services provider kickstarted the earnings season on a strong note and as a softer US inflation data boosted hopes for a US Fed rate cut.

-

- FII Poured 15,532 crores in First half of July 2024 driven by ongoing Govt Reforms, Low Fed Reserve Rates and Robust Demand.

-

- India inflation rate in India increased to 5.08% in June 2024 compared to an upward revision of 4.80% in May 2024.

-

- The Central Board of Direct Taxes (CBDT) said tax collections grew 19.54% to Rs 5.74 lakh cr till July 11 in the current financial year as compared to Rs 4.80 lakh cr in FY24 in the corresponding period.

-

- India industrial production increased 5.9 % in May 2024 compared to 5.0 % in April 2024, while manufacturing production increased 4.60 % compared to 3.90%.

-

- Active Monsoon since third week of June has boosted kharif Crops such as paddy, oilseeds, cotton and Sugarcane.

Mutual Fund Corner

Edelweiss Business Cycle NFO

An open ended High Aggressive Business Cycle NFO which helps investors to evaluate and invests in sectors & companies combining Momentum and Other Factors.

This is Predominantly a Large and Mid-Cap Portfolio focussing only top 300 Companies in Market Capitalization

This Business Cycle NFO will analyses factors to spot business cycle trends.

Key factors used in the model – Growth, Quality, Value & Momentum.

The model helps in constructing a portfolio of 60 stocks that are doing well in current cycle.

Stock of the Week

- BASF India Ltd’s portfolio consists of six segments: Agricultural Solutions, Materials, Industrial solutions, Surface Technologies, Nutrition & Care and Chemicals

- It is a part of BASF group which have 110,000 employees globally in almost every country in the world. It generated sales of 60 billion euros in 2022.

- Strong ability to service debt as the company has a low Debt to EBITDA ratio of 1.17 times

- Healthy long term growth as Operating profit has grown by an annual rate 42.13%

- With a growth in Net Profit of 96.03%, the company declared Very Positive results in Mar 24

- With ROE of 17.5, it has a Fair valuation with a 7.2 Price to Book Value

- Over the past year, while the stock has generated a return of 111.39%, its profits have risen by 43.8% ; the PEG ratio of the company is 0.9

- Multiple factors for the stock are Bullish like MACD, Bollinger Band, KST, DOW and OBV

For your Equity recommendation – open a De Mat account with Angel Broking with this link

https://app.aliceblueonline.com/openAccount.aspx?C=SSP03

This week Media Publications

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Click here to purchase the book from Amazon

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.