Weekly Wealth Report

Issue 156, Weekly Wealth Newsletter: 19th Aug 2024 – 26th Aug 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 156, Weekly Wealth Newsletter: 19th Aug 2024 – 26th Aug 2024

SEBI Proposes a New Product & Asset Classes for HNI’s

Sebi’s new asset class, positioned between MFs and PMS: how will it benefit investors?

The markets regulator has proposed a new asset class that will offer investment products positioned between mutual funds (MFs) and portfolio management services (PMS) to fill an opportunity gap for investors and offer flexibility in portfolio construction

The new product which would be introduced under the mutual fund structure, would have a minimum investment of Rs 10 lakh. The new asset class will have a risk-return profile between that of MFs and PMS, which means it will be aimed at investors who have greater risk-taking capabilities and higher investment amounts than in MFs, but lower than in PMS.

The proposed New Asset Class intends to fill the gap between MFs and PMS by offering a regulated product featuring greater flexibility, higher risk-taking capability, and a higher ticket size, to meet the needs of the emerging category of investors,”

India is finally opening to different investment products, styles and approaches.

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

Weekly Market Pulse

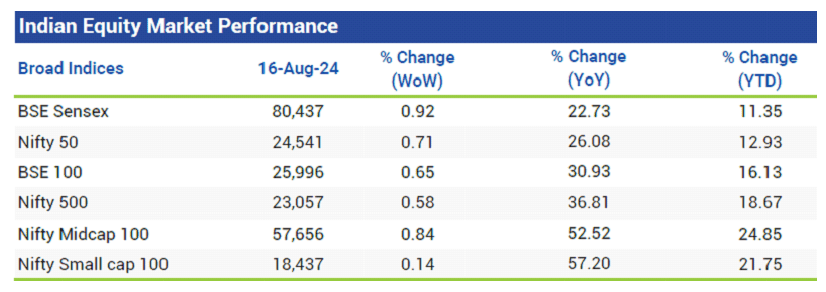

Domestic equity markets rose after witnessing fall in previous two weeks as key benchmark indices BSE Sensex and Nifty 50 rose 0.92% and 0.71%, respectively. The rally was broad-based as the mid-cap segment and the small-cap segment closed the week in green.

Domestic equity markets started the week on weaker note following domestic industrial production data of Jun 2024, indicating a lacklustre growth in the major manufacturing sector. Losses were extended following a surge in global crude oil prices amid escalated geopolitical tensions between Ukraine and Russia.

However, the trend reversed as markets recovered all the losses and witnessed gains following positive global cues as strong U.S. retail sales data of Jul 2024 and low weekly jobless claims figures allayed concerns about an impending recession in the world’s largest economy.

Gains were extended following benign U.S. consumer price inflation report of Jul 2024 that re-affirmed the expectations of rate cut by the U.S. central bank in Sep 2024.

Mutual Fund Corner

ICICI Multi Asset Fund

The multi-asset allocation Mutual Funds are deemed suitable for investors who have a low-risk appetite but want to enjoy steady returns on their investments.

The multi-asset allocation helps such investors to even out the risk that comes along with investing in just one type of asset class.

Additionally, it ensures a steady flow of income for the investors even at a time when some asset classes are underperforming than usual.

Why to consider ICICI Pru Multi Asset Fund?

1.Diversification

2.Ready Made Portfolio with Asset Allocation

3.Entry and Exit at any point

4.Automatic Rebalancing from Fund Manager

The purpose of these funds is to enhance and diversify an investment portfolio through multi-asset allocation across several asset classes. Through such an action, the fund further aims at cushioning the risks that are associated with investing in just one class of asset.

To invest in SIP & in Mutual Funds Click the link and start your investments instantly ( You can also call us @ 7810079946 )

Stock of the Week

Kotak Bank

CMP – 1778

Target – 2299 ( In 12 – 18 Month’s Time Frame)

- Kotak Mahindra Bank is a diversified financial services group providing a wide range of banking and financial services including Retail Banking, Treasury and Corporate Banking, Investment Banking, Stock Broking, Vehicle Finance, Advisory services, Asset Management, Life Insurance and General Insurance.

- Strong Long Term Fundamental Strength with an average Return on Assets (ROA) of 1.85%

- With a growth in Interest of 3.57%, the company declared Very Positive results in Jun 24

- High Institutional Holdings at 60%

- The Bank has a high Capital Adequacy Ratio of 19.58% signifying high buffers against its risk-based assets

- With ROA of 2.3, it has a Fair valuation with a 3.7 Price to Book Value

- Healthy long term growth as Net profit has grown by an annual rate of 21.72%

For your Equity recommendation – open a De Mat account with Angel Broking with this link

This Week Media Publications

How Fund Managers picks up High Performing Stocks from Stock market, Join me LIVE Stock picking online Course @ Rs. 999/-

Link above to sign up the live webinar on untold the stock picking secrets!

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Buy Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Book Online at Low Prices in India | Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Reviews & Ratings – Amazon.in

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.