Weekly Wealth Report

Issue 183, Weekly Wealth Newsletter: 24th Feb 2025 -3rd Mar 2025

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

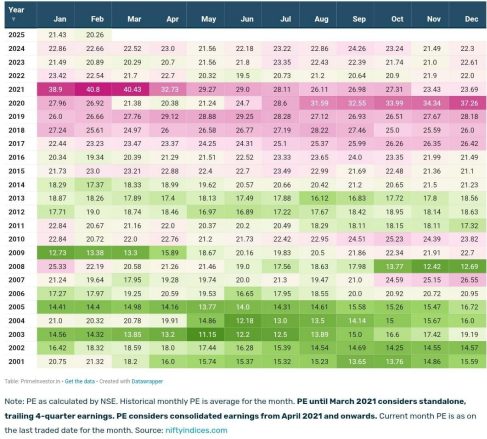

Nifty 50 Valuations drops below Covid Levels!

Download this NewsLetter as a PDF

Markets with lower price-to-earnings ratio are more attractive or better bargains than those valued higher. Indian equities have been widely considered to be the world’s most expensive ones. The latest bout of sell-off particularly by foreign portfolio investors may have prices more attractive than they have been over the last year.

Markets with lower price-to-earnings ratio are more attractive or better bargains than those valued higher.

“We are at 19 times earnings on the Nifty, and we have corrected12-13% from the top. If we assume 18 times earnings as the base, there could be another 5-6% downside left on the Nifty with the current trending.

There is no roof in Bull Market and there is no floor in Bear Market, Markets go irrational in short term and always catch up to earnings and averages in long term.

Happy Investing!

Successful investment strategy requires regular reviewing and investor should buy funds at lower levels you can always reach us @ 78100 79946 for your portfolio review and rebalance

Weekly Market Pulse

Domestic equity markets fell for the second consecutive week as key benchmark indices BSE Sensex and Nifty 50 fell 0.83% and 0.58%, respectively. However, the mid-cap segment and the small-cap segment both closed the week in green.

Domestic equity markets fell during the week on concerns surrounding potential U.S. tariffs. Sentiment was dampened following the minutes of the U.S. Federal Reserve’s Jan 2025 policy meeting, in which the central bank highlighted that the U.S. President’s proposed tariffs could potentially drive-up consumer prices, potentially delaying the reduction of interest rates even further.

India’s merchandise trade deficit widened annually to $22.99 billion in Jan 2025 compared to $16.56 billion in Jan 2024. Exports fell by 2.38% YoY to $36.43 billion in Jan 2025, and imports increased 10.28% YoY to $59.42 billion during the same period.

On the BSE sectoral front, BSE Metal rose 5.71% following positive economic indicators from China, a major consumer of metals, boosted global metal prices

Mutual Fund Corner

Invesco India Equity Savings Fund

Growth potential of equities. The net long equity exposure may help reap benefit of long term growth potential of equity

Arbitrage opportunity. Each arbitrage position in equity has a corresponding exposure in stock future which helps in reducing risk.

Fixed Income exposure. The exposure to fixed income aims to reduce volatility and generates stable income.

Bottom up and top down approach, combining growth and value buys to generate consistent outcome through all market conditions

Taxation treatment Maintains eligibility for equity taxation.

Equity exposure to be maintained in the range of 65-80%

20-35% allocation in debt and money market instruments

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 78100 79946 )

Mutual Fund Course

All you want to learn about Mutual Funds

Kickstart your Investment Journey of 2025 from here

What You will Learn:

1. A-Z of Mutual Funds

2. Master the Art of SIP’s

3. Build Wealth Like a Pro

4. Recorded session contains 8 Chapters in Tamil Language

5. Lifetime Access

My First 1 Crore Club

Still Wondering how a salaried person/professionals can make 1cr?

Why do you have to join this Community?

• Having money but still doesn’t know how & where to invest?

• Selecting wrong Stocks?

• Selecting wrong mutual funds?

• Invested in all possible ways still money haven’t doubled?

Join our First 1cr Club Webinar by payingjust 499/-

Stock Simplified Course

All you want to learn about Stock Market

Kickstart your Investment Journey of 2025 from here

Key Highlights:

1. Key entry and exit points of the stock market

2. 6-point filter to select a high-performing stock

3. Learn macro-economic trends in stock picking

This Week Media Publications

My Book Publications

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.