Weekly Wealth Report

Issue 165, Weekly Wealth Newsletter: 21st oct 2024 – 28th oct 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Markets are fallen by 6% from its Peak,

Is it a good time to add your surplus?

In the ever-fluctuating world of stock markets, investors often invoke the mantra of “buying the dip” as a tactical approach to capitalize on market downturns.

While Sensex touched 85,978 in its peak and today it is trading at 81000 levels, which is 6% of fall. Though we cannot predict the exact bottom of the stock market, this level allows investors a compelling reason to add their surplus.

This is a healthy correction for the market as this allows favourable Risk and Reward for the Investors as the Long-Term Structural Indicators are strong for Indian Economy.

Successful investment strategy requires investor to buy at lower levels and this is fall can be utilised to add your surplus, as the long-term fundamentals for Indian Stock Market remains intact.

Call us @ 78100 79946 to Handpick High Performing Funds and Stocks for your Portfolio

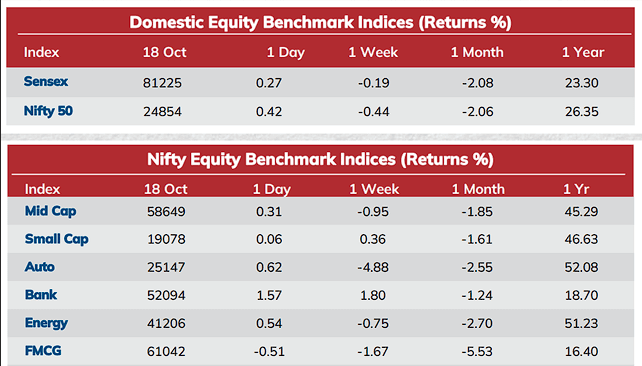

Weekly Market Pulse

- Indian equities ended higher on Friday led by gains in banking and metal stocks amid optimism over positive earnings results and slightly better-than-expected growth in China’s Q3 GDP.

- On the BSE sectoral front, BSE AUTO fell badly with losses of -4.8% followed by

Metals with -1.8% - Losses were extended following a rise in global crude oil prices amid escalating tensions in the Middle East due to the Israel-Iran conflict

- FII withdrew -71,274 Cr for month till date

- DII Invested 74,175 Cr so far for month till date

- The Reserve Bank of India’s (RBI) Governor Shaktikanta Das said an interest rate cut at this stage will be ‘premature, and very, very risky’

- The yield of the new 10-year benchmark 07.10% 2034 paper closed higher at 6.82% on Friday compared to 6.78% on Thursday.

Mutual Fund Corner

Invesco India Flexi Cap

Equity markets are often unpredictable – economic factors, government policies, global and domestic events can cause upward and downward movements across Large, Mid and Small caps.

What you need is a fund that offers Expertise and Flexibility – navigating through market movements with the aim to capture opportunities across market caps, and help you build long term wealth.

Why to invest in Invesco Flexi Cap Fund?

- Top Quartile Flexi Cap Fund for 2024

- This fund pursues opportunities across the market cap range and sectors Entry and Exit at any point

- Facilitates longevity of stock ownership as the fund does not have to rebalance portfolio due to market cap changes

- Diversification helps to generate consistent outcomes over long term while lowering risk

Flexi Cap Investing help investor to balance both Risk and Returns

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 78100 79946 )

Stock of the Week

Ashoka Buildcon

CMP – 246

Target – 299 ( In 12 – 18 Month’s Time Frame)

- Ashoka Buildcon Ltd is engaged in the business of construction and infrastructure facilities on EPC and BOT basis. It is also involved in the sale of RMC (ready mix concrete)

- High Institutional Holdings at 27%

- With a growth in Net Profit of 119.68%, the company declared Very Positive results in Jun 24

- OPERATING PROFIT TO INTEREST(Q) Highest at 1.94 times

- With ROCE of 27.9, it has a Very Attractive valuation with a 1.7 Enterprise value to Capital Employed

- The stock is trading at a discount compared to its average historical valuations

- PAT(Q) At Rs 150.33 cr has Grown at 122.0 %

- High Management Efficiency with a high ROCE of 27.04%

For your Equity Recommendation, Pls call us 63795 18807

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Buy Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Book Online at Low Prices in India | Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Reviews & Ratings – Amazon.in

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.