Weekly Wealth Report

Issue 158, Weekly Wealth Newsletter: 2nd Sep 2024 – 9th Sept 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 158, Weekly Wealth Newsletter: 2nd Sep 2024 – 9th Sep 2024

Market Hits All Time High –

Bulls Take Charge

August ended on a high note for the Indian equity markets, with frontline indices like the Nifty and Sensex touching record highs, and the Nifty breaking a 31-year record for the longest streak of gains.

The last two weeks saw every trading session close in the green, culminating in 12 consecutive days of gains, with the Nifty up by 4.5%.

This 11-session winning streak was last witnessed in November 1993, signalling that the bulls are charging ahead without hesitation.

Despite initial concerns at the start of the month due to an appreciating Japanese Yen, heightened geopolitical tensions, and concerns of a hard landing in the U.S., the markets climbed every wall of worry.

The rally defied expectations of a correction as the month progressed, driven by optimism in global markets and the subsiding of all initial concerns.

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

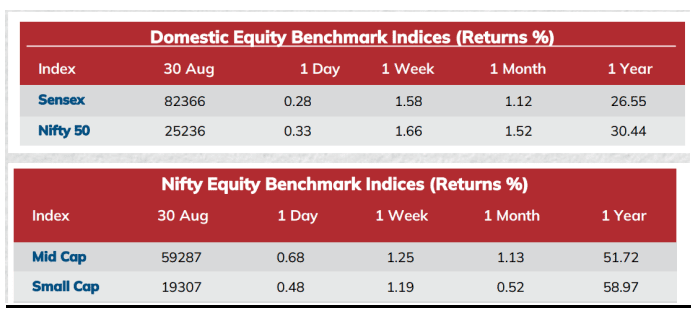

Weekly Market Pulse

Indian equities rallied to record high on Friday, boosted by gains in financial and banking stocks amid positive global cues after positive US growth data.

India’s eight core sectors output growth rose to 6.1% in July, compared to upward revision of 5.1% growth in June.

India’s gross domestic product grew at 6.7% for Q1FY25, against 8.2% in the year-ago period.

GST collections in August went up by 10% from the same period last year to Rs 1.74 lakh cr.

India’s Forex reserves were up by $7.02 bn to touch an all-time high of $681 bn as of August 23

The government fiscal deficit in the first four months of FY25 touched 17.2% of the annual target, against 33.9% a year before

Mutual Fund Corner

ICICI Balanced Advantage Fund

ICICI Balanced Advantage Mutual Funds are deemed suitable for investors who have a low-risk appetite but want to enjoy steady returns on their investments.

This Hybrid Fund helps such investors to even out the risk that comes along with investing in just one type of asset class.

Why to consider ICICI Pru Balanced Advantage Fund?

- Low Beta Fund

- Ready Made Portfolio with Automatic Asset Allocation & Rebalancing

- Entry and Exit at any point

The purpose of these funds is to enhance and diversify an investment portfolio through Auto Asset Allocation across Debt & Equity. This will ensure your portfolio yield reasonable returns with very low volatility. Investors who wish to participate in equity markets with relatively conservative approach can invest in this scheme

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 7810079946 )

Stock of the Week

TCS

CMP – 4551 Target – 5499 ( In 12 – 18 Month’s Time Frame)

Tata Consultancy Services is the flagship company and a part of Tata group. It is an IT services, consulting and business solutions organization that has been partnering with many of the world’s largest businesses in their transformation journeys for over 50 years.

Company is almost debt free.

Company has a good return on equity (ROE) track record: 3 Years ROE 47.4%

High Institutional Holdings at 23%

Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 40.36%

The company has declared positive results for the last 6 consecutive quarters

Healthy long term growth as Net Sales has grown by an annual rate of 10.18%

Multiple factors for the stock are Bullish like MACD, Bollinger Band, KST and DOW

For your Equity recommendation – open a De Mat account with Alice Blue with this link

This Week Media Publications

Click here to Visit Nanayam Vikatan Article by Sathish Kumar

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Buy Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Book Online at Low Prices in India | Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Reviews & Ratings – Amazon.in

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.