Weekly Wealth Report

Issue 177, Weekly Wealth Newsletter: 13th Jan 2024 – 20th Jan 2025

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

How to Create a Sustainable Wealth with Simple Strategy?

Download this NewsLetter as a PDF

The fascinating story of Ronald Read, an American janitor and gas station attendant who, when he passed away in 2014, left behind an $8 million ( Rs 64 Crore ) fortune.

This story can be more relevant when the markets are going down and majority of the investors feeling anxious about the downtrend. The striking story is not about some magical investment strategy or discovering the next big thing.

This gentleman working as a Janitor and investing in Stocks for 25 years. When he died, his portfolio included 95 stocks across industries like healthcare, telecommunications, utilities, and

consumer goods.

He believed only in long term investing, and he allowed his money to grow and compound over decades.

Most investors chase the noise: “What’s the high performing Mutual Funds and Stocks?” “Is the market crashing?” This approach is a recipe for disappointment.

Seasoned wealth builders know real wealth grows quietly. It’s built by investing in fundamentally strong companies and letting them thrive over time. The Long-Term Growth Portfolio is crafted with this principle at its core—and it goes one step further.

This story offers valuable lessons to all Investors at todays context, wealth creation happens when you are patient investor for decade or at least for 5 complete years.

The next time you feel the urge to make dramatic changes to your portfolio or chase the latest investment trend or the temporary losses in the stock market, remember Mr Richard, the Janitor who made 64 Crore.

Successful investment strategy requires regular reviewing and investor should buy funds at lower levels you can always reach us @ 78100 79946 for your portfolio review and rebalance

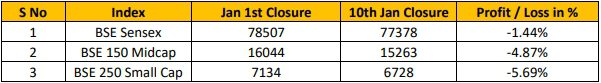

Weekly Market Pulse

Domestic equity markets fell after posting a spectacular gain on 2nd Jan as key benchmark indices BSE Sensex fell around 1.44%.

The fall was broad-based as the mid-cap segment and the small cap segment fell further closed in red with 4.87% and 5.69% respectively.

Losses widened due to the weakening rupee and heavy selling by foreign institutional investors.

Indian equities closed lower on Friday due to declines in heavyweight financial and energy stocks as investors were concerned about corporate earnings.

India Manufacturing Production increased 5.80% in November compared to 4.10% in October.

The top losers were Shriram Finance, IndusInd Bank, Adani Enterprises, NTPC and Bharat Electronics Ltd, which were down 3.64-5.33%.

The top gainers were TCS, Tech Mahindra, HCL Tech, Wipro and Infosys, which were up 2.59-5.62%

US unemployment rate went down to 4.1% in December from 4.2% in November

Mutual Fund Corner

Edelweiss Balanced Advantage Fund

The fund dynamically changes asset allocation across equity, debt, cash and derivatives (including hedges), based on valuation cycles

The Fund manager will increase the exposure to equity when market valuations are attractive and will prune the equity exposure by increasing cash or debt exposure and/or through hedging when equity markets get expensive or experience volatility.

Allocation to equities and debt & money market instruments can be in the range of 0% – 100%.

Asset allocation is determined based on proprietary model combining valuation parameters like P/E & P/B along with the yield gap to determine net equity allocation.

The model may use qualitative overlay of fund management team from time to time to arrive at final equity allocation

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 78100 79946 )

Stock of the Week

Mastek

CMP – 2950

Target – 3599 ( In 12 – 18 Month’s Time Frame)

Established in 1982, Mastek is a provider of vertically-focused enterprise technology solutions. Having its presence in IT industry for almost 4 decades, Mastek Ltd has evolved from an IT solutions provider to Digital transformation partner.

Strong Long Term Fundamental Strength with an average Return on Capital Employed (ROCE) of 93.11%

Healthy long term growth as Net Sales has grown by an annual rate of 25.96% and Operating profit at 31.54%

Nil debt company

Positive results in Sep 24

High Institutional participation of 22%

With ROCE of 17.3, it has a Attractive valuation with a 3.8 Enterprise value to Capital Employed

For your Equity Recommendation, Pls call us 78100 79946

Mutual Fund Course

All you want to learn about Mutual Funds

Kickstart your Investment Journey of 2025 from here

What You will Learn:

1. A-Z of Mutual Funds

2. Master the Art of SIP’s

3. Build Wealth Like a Pro

4. Recorded session contains 8 Chapters in Tamil Language

5. Lifetime Access

My First 1 Crore Club

Still Wondering how a salaried person/professionals can make 1cr?

Why do you have to join this Community?

• Having money but still doesn’t know how & where to invest?

• Selecting wrong Stocks?

• Selecting wrong mutual funds?

• Invested in all possible ways still money haven’t doubled?

Join our First 1cr Club Webinar by payingjust 499/-

Stock Simplified Course

All you want to learn about Stock Market

Kickstart your Investment Journey of 2025 from here

Key Highlights:

1. Key entry and exit points of the stock market

2. 6-point filter to select a high-performing stock

3. Learn macro-economic trends in stock picking

This Week Media Publications

My Recent Article in Nanayam Vikatan – Don’t do these 5 Purchases / Spending. Get your copy at your nearest book store.

My Book Publications

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.