The quote which comes to mind by Vladimir Ilyich Lenin

“There are decades, where nothing happens; and there are weeks

where decades happen”

2023 was a year of Turbulent. There were many Reg Flags like…

- Russia Conflict ( Still Not resolved )

- Interest Rate Hike in US

- Soaring Inflation in US

- Hidenburg Report on Adani

- Falling US Banks ( Silicon Valley and Silver Gate )

- Deep Property Crisis in China

- Israel and Palestine Geo Conflict

- Oil Price Hike

But still 2023 was a robust year beating all the sentiments

and emerged as a noteworthy winner.

No one can bet against India

If you think, you need any help in investing, reach us

@ 63795 18807

Market Outlook for 2024

The bull-run in Indian financial markets is likely to continue in 2024 as foreign interest remains robust, with heavy buying expected in both equity and debt markets, said several analysts and industry watchers.

Domestic equity benchmarks Nifty 50 and BSE Sensex rose around 20 per cent in 2023, their second-best year since 2017, and were among the top-performing stock indexes globally.

The broader small- and mid-caps gained about 55.62 per cent and 46.57 per cent in 2023, far outperforming the blue-chip indexes

despite valuation concerns.

On the last trading session of 2023, the Nifty 50 settled at 21,731.40

and Sensex closed at 72,240.

The BSE Mid cap and Small cap indices hit their fresh record highs

of during the session.

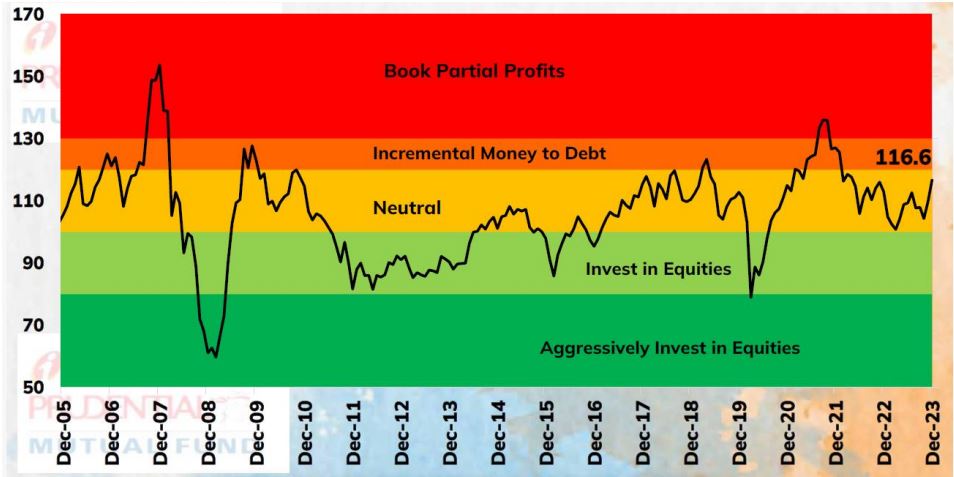

Equity Valuation Zone

- If you are thinking Indian Markets are at 5 week high and Equity is at over expensive zone, it is not. It is inclining from neutral to expensive zone.

- Our Equity Valuations Index for the month indicates that valuations are not cheap and continue to remain in the neutral zone. Thus, we recommend investing in equity schemes having flexible investment mandate coupled with Hybrid and Multi Asset allocation schemes that may help navigate market volatility.

Key Macro Metrics for 2024

- India attracted $16 billion from foreign portfolios and $22 billion from domestic institutional investors in 2023

- India’s equity indices hit record highs with the Nifty 50 up by 18.4%, BSE Sensex up by 17.3%, mid cap 100 up by 44% and small cap 100 up by 52.8% propelling market cap beyond the $4 trillion mark

- India’s growth trajectory is expected to remain on a strong course supported by a recovery in capex and industrial activity

- Mid and small cap stocks trade notably high above historic premiums compared to large caps

- Overall, stronger economic growth prospects and an improving earnings outlook are expected to augur well for equities in 2024

- OPERATING PROFIT TO INTEREST(Q) Highest at 14.24 times

- Key Sectors to Invest are Real Estate, Banking, Capital Goods, Auto, Telecom

Challenges for 2024

- High Returns from Equity Market in 2023

- 2024 – Elections may cause volatility

- Global Sentiment, Geo Political Events

- Inconsistent Govt Policies ( If in case of New Govt )

How and where to Invest in 2024?

1. Follow STP – Approach for Lumpsum

2. Follow SIP Approach for Long term Investments

3. Mutual Funds are the best bet among all products

4. Invest in Large Cap & Mega Caps

5. Follow Asset Allocation ( Diversify your Assets )

Hope you will find this helpful in your wealth creation journey.

Pls call us @ 78100 79946 to Multiply your wealth

This News letter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689 You can also connect with us investments@sathishspeaks.com Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme related documents carefully. Past performance of the mutual fund is not necessarily indicative for future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purpose only and contains information, opinion, material obtained from reliable sources and every effort has been made to avoid errors and omissions and is not to be construed as an advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means are prohibited.