Weekly Wealth Report

3rd June 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 145, Weekly Wealth Newsletter: 3rd June 2024 – 10th June 2024

Exit Poll Rally. One Day Returns Vs One Decade Returns

While Exit Poll has predicted a huge sweep for ruling BJP Party. But the actual number might cross 350 as well.

Recently the Stock Market Valuation crossed $ 5 Trillion and this has a potential to cross even $ 10 trillion in 4 – 5 Years.

Another important factor is how foreign investor will react, If FPI start to buy in Indian market, the market could register huge and swift gains.

The potential for a strong NDA victory has created optimism among investors who believe that the continuation of Modi's policies will further boost the growth and profitability of these companies.

The currency market also witnessed a stronger start on the back of stronger equity markets. In the first trading session of this week, the Indian rupee opened at 82.99 against the US dollar. The rupee had closed 82.46 against the American currency on Friday. Dollar index, which measures greenback against six global currency, slipped 0.04 per cent lower at 104.63.

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

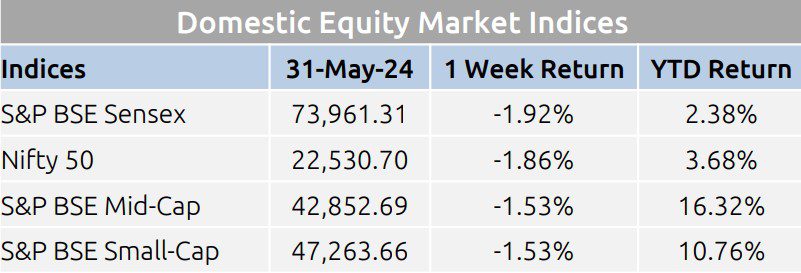

Weekly Market Update

- BSE Sensex hits life time high and up over 2000 Points

- Stock Market Today | BSE Sensex, Nifty50 Live: BSE Sensex and Nifty50, the Indian equity benchmark indices, surged in opening trade on Monday to hit life-time highs on the back of most Lok Sabha election exit polls showing the Prime Minister Narendra Modi returning for a third term

- While BSE Sensex scaled above the 76,000 level, Nifty50 was above 23,100. Most exit polls have predicted that the Bharatiya Janata Party (BJP)-led National Democratic Alliance (NDA) will secure a thumping majority with many of them even saying that PM Modi’s ‘400 Paar’ target may be crossed. The counting of votes for the Lok Sabha elections, which took place in seven phases, will take place on June 4, 2024.

- Government data showed that Gross Domestic Product (GDP) of the Indian economy at constant (2011-12) prices witnessed a growth of 7.8% in the fourth quarter of FY24. In the Jan-Mar quarter of last year, the GDP growth rate was 6.2%. On the sectoral front, the growth of the manufacturing sector soared to 8.9% in Q4 of FY24 from 0.9% in same quarter of previous fiscal year

Mutual Fund Corner

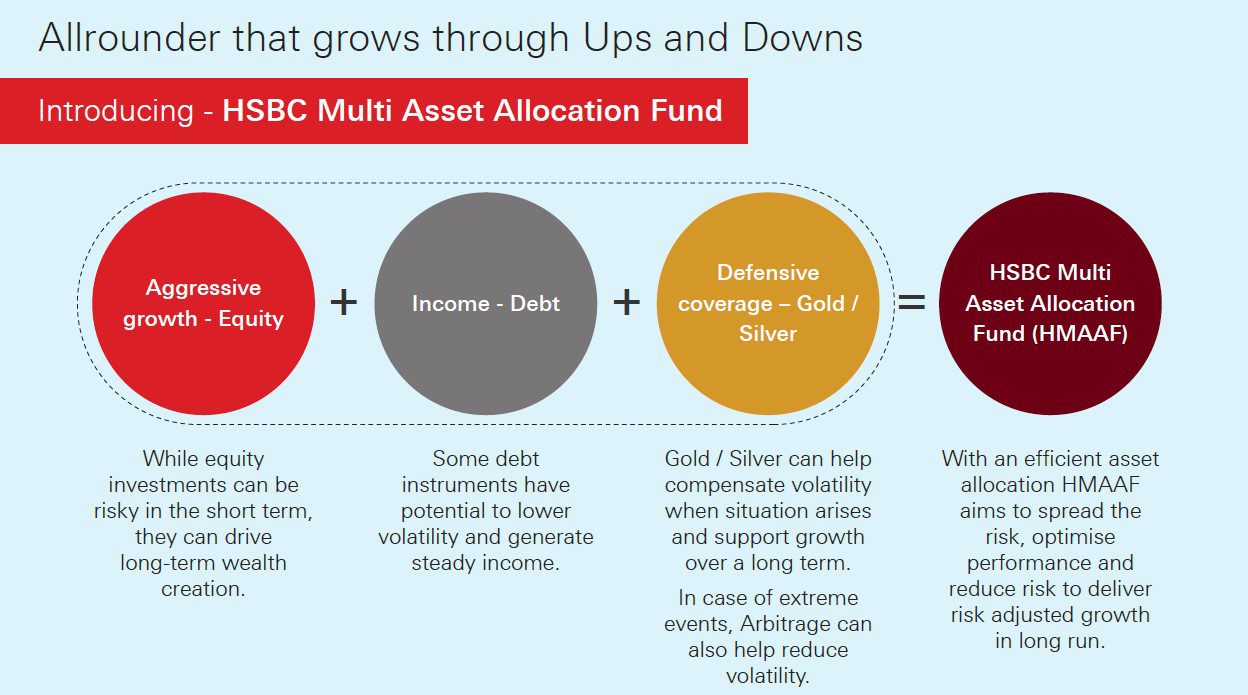

HSBC Multi Asset Fund

Every portfolio needs different asset classes that can combine to provide return potential while adjusting risk. Choose a fund that invests in equity for growth potential while debt and Gold / Silver can help to balance risks in volatile market conditions.

Multi Asset Funds are best pick for Risk Adjusted Performances

Stock of the Week

CAMS

CMP – 3591

Target – 4299 ( In 12 – 18 Month’s Time Frame)

For your Equity recommendation – open a De Mat account with Angel Broking with this link

https://app.aliceblueonline.com/openAccount.aspx?C=SSP03

This week Media Publications

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Click here to purchase the book from Amazon

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.