Weekly Wealth Report

Issue 181, Weekly Wealth Newsletter: 10th Feb 2025 -17th Feb 2025

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Decoded 5 Strong Sectors from Budget 2025

Download this NewsLetter as a PDF

Have you heard the term “Lifestyle upgradation”? Well, Budget 2025 just made it affordable. With tax cuts in play, your wallet might feel heavier.

Thus, you can now fuel both your shopping cart and our portfolio i.e. more consumption and investment opportunities. But what are those sectors that will supposedly benefit from Budget 2025? Let’s find out!

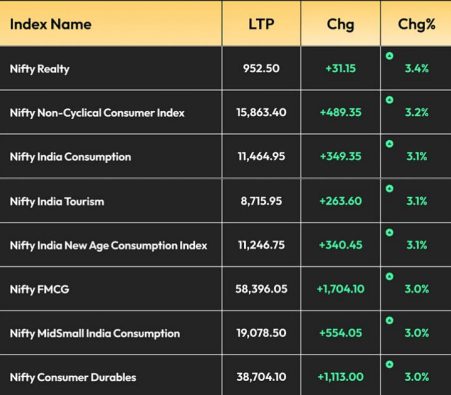

On 1st Feb the finance minister announced a tax cut in budget 2025, due to which consumption-led sectors shot up by more than 3%.

FMCG, Automobile, Tourism, Consumer Durable and Entertainment sectors will remain in focus for 2025, as they are expected to benefit from increased spending.

What should you do?

Understand that the Budget provides you with a broad picture of which sectors will be in focus for the next 1-2 years.

However, not all companies in these sectors will experience similar growth. Some will do exceptionally well, while others may fall flat.

Thus, identifying strong players with strong financials and growth prospects becomes important.

Happy Investing!

Successful investment strategy requires regular reviewing and investor should buy funds at lower levels you can always reach us @ 78100 79946 for your portfolio review and rebalance

Weekly Market Pulse

The Monetary Policy Committee (MPC) in its sixth bi-monthly monetary policy review of FY25 reduced key policy repo rate by 25 bps to 6.25% with immediate effect

The RBI has projected real GDP growth for FY26 at 6.7% with Q1 at 6.7%, Q2 at 7.0%, and Q3 and Q4 at 6.5% each, with risks are evenly balanced.

The RBI has projected CPI inflation for FY25 at 4.8% with Q4 at 4.4%

Domestic equity markets rose for the second consecutive week as key benchmark indices BSE Sensex and Nifty 50 rose 0.46% and 0.22%, respectively. The small-cap segment closed the week in green,

however, the mid-cap segment closed the week in red.

Domestic equity markets rose after the U.S. President delayed tariffs on Mexico and Canada for a month but gave China no such relief

The Manufacturing Purchasing Managers’ Index rose to 57.7 in Jan 2025 compared to 56.4 in Dec 2024, it marked the fastest expansion since last Jul 2024

Mutual Fund Corner

Invesco India Equity Savings Fund

Growth potential of equities. The net long equity exposure may help reap benefit of long term growth potential of equity

Arbitrage opportunity. Each arbitrage position in equity has a corresponding exposure in stock future which helps in reducing risk.

Fixed Income exposure. The exposure to fixed income aims to reduce volatility and generates stable income.

Bottom up and top down approach, combining growth and value buys to generate consistent outcome through all market conditions

Taxation treatment Maintains eligibility for equity taxation.

Equity exposure to be maintained in the range of 65-80%

20-35% allocation in debt and money market instruments

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 78100 79946 )

Stock of the Week

Hyundai India Motor Ltd

CMP – 1871

Target – 2399 (In 12 – 18 Month’s Time Frame)

Incorporated in May 1996, Hyundai Motor India Limited is a part of the Hyundai Motor Group, which is the third largest auto original equipment manufacturer in the world based on passenger vehicle sales.

HMI offers a broad portfolio of 13 models, including sedans, hatchbacks, SUVs, and electric vehicles (EVs). It has been a key exporter, ranking second in India from April 2021 through June 2024, and has sold nearly 12 Mn vehicles domestically and internationally since inception.

With PE of 26, it has an Attractive valuation with its peers

High Institutional Holdings at 14% ( Promotor holds 82% )

Company is almost debt free.

Company has delivered good profit growth of 18.1% CAGR over last 5 years

Company has a good return on equity (ROE) track record: 3 Years ROE 27.4%

Company has been maintaining a healthy dividend payout of 111%

For your Equity Recommendation, Pls call us 78100 79946

Mutual Fund Course

All you want to learn about Mutual Funds

Kickstart your Investment Journey of 2025 from here

What You will Learn:

1. A-Z of Mutual Funds

2. Master the Art of SIP’s

3. Build Wealth Like a Pro

4. Recorded session contains 8 Chapters in Tamil Language

5. Lifetime Access

My First 1 Crore Club

Still Wondering how a salaried person/professionals can make 1cr?

Why do you have to join this Community?

• Having money but still doesn’t know how & where to invest?

• Selecting wrong Stocks?

• Selecting wrong mutual funds?

• Invested in all possible ways still money haven’t doubled?

Join our First 1cr Club Webinar by payingjust 499/-

Stock Simplified Course

All you want to learn about Stock Market

Kickstart your Investment Journey of 2025 from here

Key Highlights:

1. Key entry and exit points of the stock market

2. 6-point filter to select a high-performing stock

3. Learn macro-economic trends in stock picking

This Week Media Publications

This week at Nanayam Vikatan, What an Investor Should do in Falling Market?

My Book Publications

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.