Weekly Wealth Report

Issue 166, Weekly Wealth Newsletter: 28th oct 2024 – 4th nov 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Clean up your Mutual Fund and Stock Portfolio for this Diwali

- This is Diwali week, you should be cleaning up your house and removing useless stuffs and clear the clutter, the same you should do it for your Stocks and Mutual Fund Portfolio as well.

- It is the time you should rebalance underperforming Mutual Funds and Stocks and realign your portfolio with your Risk and improve your Returns.

- What if I ask, how many Mutual Funds or Stocks you have in your portfolio and what is your XIRR for last 1 year? And whether is it beating the benchmark or not?

Successful investment strategy requires regular reviewing and investor should buy funds at lower levels you can always reach us @ 78100 79946 for your portfolio review and rebalance

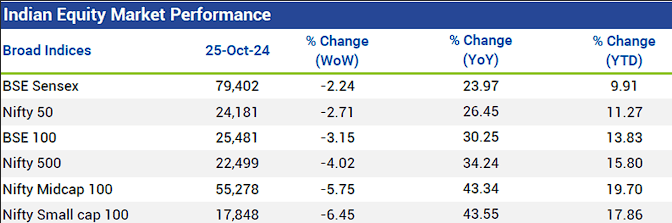

Weekly Market Pulse

Domestic equity markets fell for the fourth consecutive week as key benchmark indices BSE Sensex and Nifty 50 fell 2.24% and 2.71%, respectively. The fall was broad-based as the midcap segment and the small-cap segment both closed the week in red, with significant losses.

Domestic equity markets fell due to a sell-off across the sectors as sentiment was dented following muted earnings reported by major domestic companies for the second quarter so far.

Losses were extended due to persistent selling by foreign portfolio investors in domestic markets and subsequent transfer of funds to China following Beijing’s announcement of various stimulus plans to accelerate economic expansion

Sentiment was dampened further following a rise in U.S. Treasury yields amid easing expectations of aggressive rate cuts by the U.S. Federal Reserve

Additionally, a cautious undertone prevailed due to anxiety over the impending U.S. election and heightened tensions in the Middle East.

Among the sectors Capital goods followed by Oil & Gas sector fell the most, while Information technology sector witnessed the least fall.

Mutual Fund Corner

Invesco India Flexi Cap

Equity markets are often unpredictable – economic factors, government policies, global and domestic events can cause upward and downward movements across Large, Mid and Small caps.

What you need is a fund that offers Expertise and Flexibility – navigating through market movements with the aim to capture opportunities across market caps, and help you build long term wealth.

Why to invest in Invesco Flexi Cap Fund

- Top Quartile Flexi Cap Fund for 2024

- This fund pursues opportunities across the market cap range and sectors Entry and Exit at any point

- Facilitates longevity of stock ownership as the fund does not have to rebalance portfolio due to market cap changes

- Diversification helps to generate consistent outcomes over long term while lowering risk

Flexi Cap Investing help investor to balance both Risk and Returns

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 78100 79946 )

Stock of the Week

Infosys

CMP – 1868

Target – 2299 ( In 12 – 18 Month’s Time Frame)

- Infosys Ltd provides consulting, technology, outsourcing and next-generation digital services to enable clients to execute strategies for their digital transformation. It is the 2nd largest Information Technology company in India behind TCS

- With its market cap of Rs 7,69,497 cr, it is the second biggest company in the sector (behind TCS)and constitutes 16.82% of the entire sector

- Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 27.14%

- High Institutional Holdings at 71.4%

- With ROE of 29.8, it has a Fair valuation with a 8.5 Price to Book Value

- Stock is technically in a Mildly Bullish range, multiple factors for the stock are Bullish like MACD, KST and DOW

- Nil debt company

For your Equity Recommendation, Pls call us 78100 79946

This Week Media Publications

My Publications

My First 1 Crore Club

Are you still dreaming to achieve a net worth of ₹1 crore?

Still dreaming how to make 1crore?

Still Wondering how a salaried person/professionals can make 1cr?

To all the questions in your mind here is the potential ways to build it through Mutual Funds, Stocks and Much More…

Still dreaming how to make 1crore?

Still Wondering how a salaried person/professionals can make 1cr?

To all the questions in your mind here is the potential ways to build it through Mutual Funds, Stocks and Much More…

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.