Issue 132, Weekly Wealth Newsletter: 4th Mar 2024 – 11th March 2024

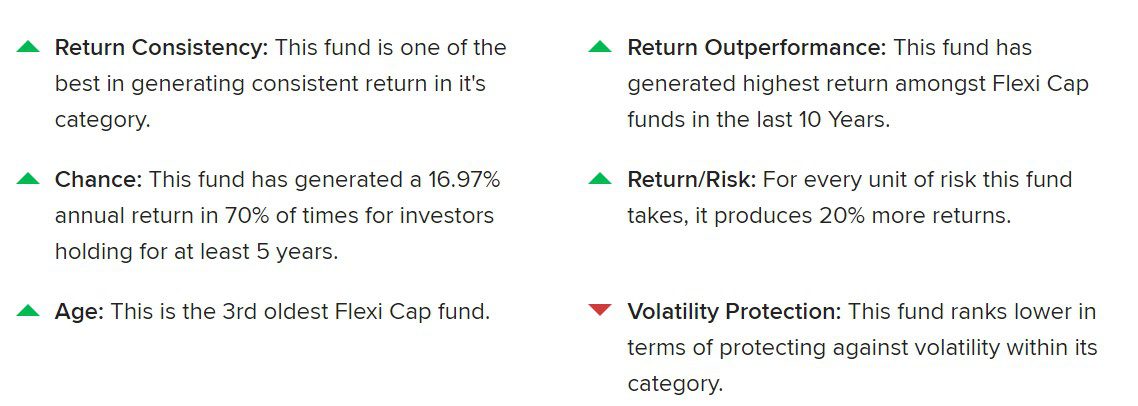

Nippon India Value Fund delivered an annualised return of 17.75 percent in the past 10 years. The benchmark index (Nifty 500 TRI) returned during the same period lower than this and stood at 15.20 percent. This is a popular fund with a total asset under management (AUMs) of ₹5,763 crore.

In fact, it is not only this fund – Many such funds have delivered such Steller performances, but the question is - Are you investing for a long term and is your portfolio is enjoying the compounding? This is a doctrine that appeals to every investor who is in the market for a long haul.

Call us @ 63795 18807 to know High Performing Mutual Funds

Weekly Market Update

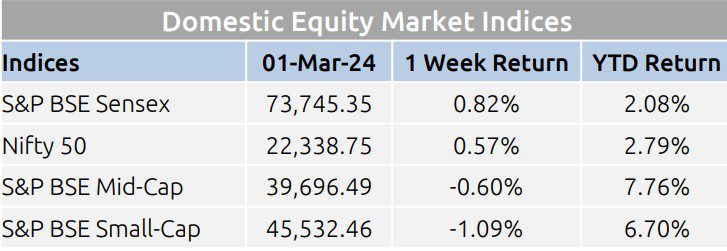

- Domestic equity markets rose for the third consecutive week as key benchmark indices S&P BSE Sensex and Nifty 50 rose 0.82% and 0.57% respectively, however, both the midcap segment and small-cap segment closed the week in red.

- Domestic equity markets reached fresh high after domestic economy surprised the markets with a faster-than anticipated growth rate in the December quarter of FY24.

- Government data showed that Indian economy grew by roust 8.4% in the Q3 of FY24, with an upward revision in the numbers of Q1 and Q2 data for this fiscal. Sentiments were further boosted following the slower growth of the U.S. personal consumption expenditure price index in Jan 2024 in nearly three years.

- Government data showed that Indian economy grew by roust 8.4% in the Q3 of FY24, with an upward revision in the numbers of Q1 and Q2 data for this fiscal. Sentiments were further boosted following the slower growth of the U.S. personal consumption expenditure price index in Jan 2024 in nearly three years.

- On the BSE Sectoral front, S&P BSE Capital Goods surged 3.72% following the robust growth of domestic economy during Oct-Dec quarter of FY24. S&P BSE METAL experienced gain of 1.83% following the growth in the manufacturing sector

- S&P BSE Health Care witnessed a fall of 2.94% following the Supreme Court's discovery of the discrepancy in costs between government and private hospitals for different medical procedures following a public interest lawsuit brought by an NGO

Mutual Fund Corner

Quant Flexi Cap Fund

Flexi Cap Fund : The fund has 87.21% investment in domestic equities of which 29.63% is in Large Cap stocks, 16.81% is in Mid Cap stocks, 27.38% in Small Cap stocks. The fund has 4.89% investment in Debt, of which 4.89% in Government securities

Stock of the Week

Mahanagar Gas

CMP – 1538

Target – 1800 ( In 12 – 8 Months Time Frame)

The stock is trading at a discount compared to its average historical valuations

For your Equity recommendation – open a De Mat account with Angel Broking with this link

This week Media Publications

Middle Class to Million Dollar Book

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.