A Story of a Over Confident Customer. He was reasonably Rich & living a

comfortable Life. His son completed Chartered Accountant in 2022. As he was a Proud Father, he wanted his son to Manage his Portfolio. He Believed that Stock Market Investing is all about Number Crunching and Balance Sheet Analysis.

He pulled out all money and handed over his portfolio to his Son. But in 1 year, he come back again and mentioned that his son lost 45% Money on his Portfolio, while the market has given exceptional returns in 2023.

This is called Over Confidence Bias. That kid thought he knows more than everybody else just because he is a Chartered Accountant. That Bias made him to lose his father’s hard-earned money.

Investments does not only require to understand the Balance Sheet but to view the Stock Market as Business. Respect Market, they are interesting because most of us cannot understand them.

Call us @ 63795 18807 to Invest in Mutual Funds and Stock Market

Take advantage and grow with the Indian Stock market

Weekly Market Update

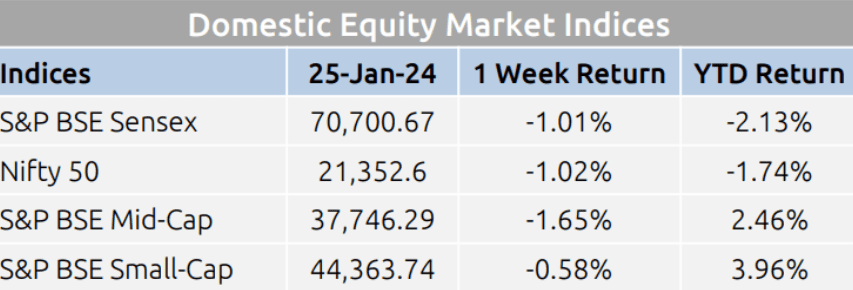

Domestic equity markets fell for the second consecutive week as key benchmark indices S&P BSE Sensex and Nifty 50 fell 1.01% and 1.02% respectively

The fall in the market was broad-based as the mid-cap segment and the small-cap segment also closed the week in red.

Domestic equity markets fell to heavy sell-off across the sectors as sentiments were dampened following the SEBI’s draft paper that aimed to tighten ultimate beneficial ownership norms for overseas investors with effect from Feb 1, 2024

Muted Q3FY24 earnings of some index heavyweight companies extended the losses further. Sentiments were further dampened following rise in U.S. Treasury yields that attracted the foreign portfolio investors away from domestic markets.

On the BSE sectoral front, S&P BSE Realty fell 4.45% following the drop in investments from U.S. institutions in the domestic real estate market that fell by 39% in 2023 to $1.35 billion amid global uncertainties

S&P BSE Power rose 1.52% after data showed that the country’s electricity generation rose 8.7% YoY in December quarter and average peak demand during the quarter increased 13.8% YoY to 218 gigawatts.

Mutual Fund Corner

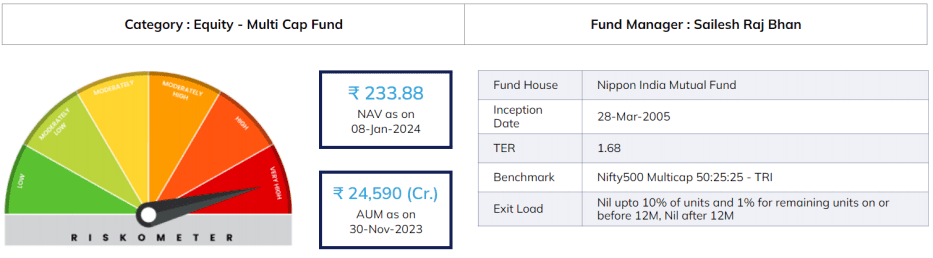

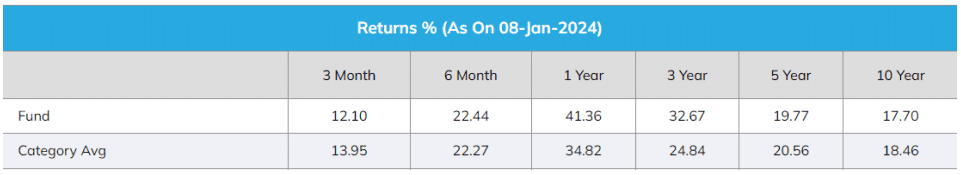

Nippon Multi Cap Fund

The primary investment objective of the scheme is to seek to generate capital appreciation & provide long term growth opportunities by investing in a portfolio constituted of equity securities & Equity related securities and the secondary objective is to generate consistent returns by investing in debt and money market securities.

The fund has 98.37% investment in domestic equities of which 36% is in Large Cap stocks, 21.97% is in Mid Cap stocks, 23.75% in Small Cap stocks.

To invest in SIP & in Mutual Funds Click the link and start your investments instantlyz

Stock of the Week

Persistent Systems

CMP – 8639

Target – 10,500 ( In 6 – 12 Months Time Frame)

Low Debt Company with Strong Long Term Fundamental Strength

Healthy long term growth as Net Sales has grown by an annual rate of

23.61% and Operating profit at 32.31%

The company has been able to generate a Return on Capital Employed (avg) of 31.38% signifying high profitability per unit of total capital (equity and debt)

With ROE of 22.7, it has a Very Attractive valuation with a 14.6 Price to Book Value

The stock is trading at a premium compared to its average historical valuation

Over the past year, while the stock has generated a return of 88.71%, its profits have risen by 15.4% ; the PEG ratio of the company is 4.3

High Institutional Holdings at 50.69%

For your Equity recommendation – open a De Mat account with Angel Broking with this link

This News letter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689 You can also connect with us investments@sathishspeaks.com Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme related documents carefully. Past performance of the mutual fund is not necessarily indicative for future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purpose only and contains information, opinion, material obtained from reliable sources and every effort has been made to avoid errors and omissions and is not to be construed as an advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means are prohibited.