Weekly Wealth Report

17th June 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 147, Weekly Wealth Newsletter: 17th June 2024 – 24th June 2024

Are Budget and US Elections being Next Biggest Trigger?

The newly elected Finance Minister Nirmala Sitharaman is likely to begin the budget preparation process, highlighting the importance of meticulous planning and comprehensive analysis.

The Union Budget is expected to improve the Job opportunities, PLI Schemes (Product Linked Incentives). MSME, GST Rationalising and Infra Projects

Stock Market will cheer, if the govt continues their spending on Infrastructure and continuity on its Monetary Policies and Fiscal Deficit.

All eyes are on the government's budgetary decisions because it will have a profound impact on the stock market, influencing sector performance, corporate profits, interest rates, inflation expectations and market sentiment.

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

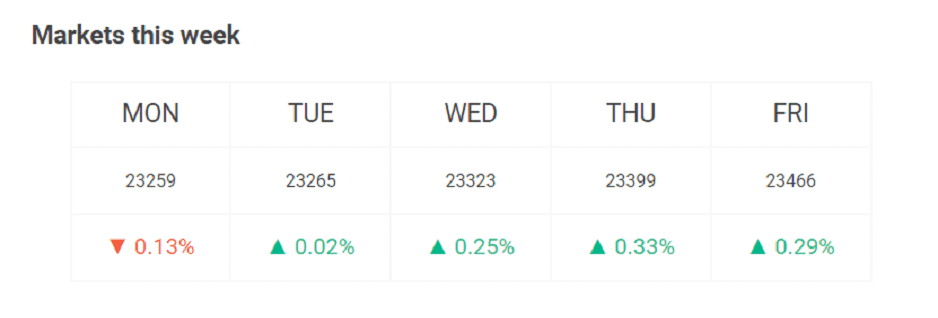

Weekly Market Update

- World Bank Retains Indian GDP Growth at 6.6% for FY 25

- FY 26 and FY 27 growth Forecast is around 6.7% and 6.8% respectively

- GST Council is expected to meet on 22nd June 2024

- Media reports indicates that Fuel Prices could come under GST

- Due to unusual surge in Gold Imports, govt restricts gold imports again

- May 2024 CPI Inflation stood at 4.8% unchanged and well below market expectation

- Core Inflation is reported at 3.1%, which is lowest at the current inflation series from RBI

- Market cheers with the expectation of a good monsoon, which can push up rural demand, consumption, and eases Agri Inflation.

- PLI Schemes are expected to create 2 Lakh additional Jobs and to increase the turn over by INR 3 to 4 Trillion in Next 4 Years

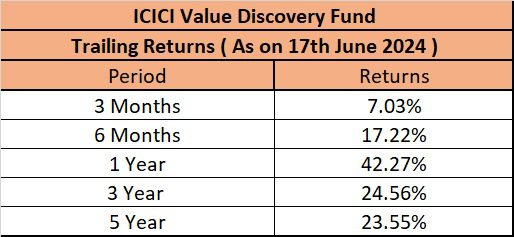

Mutual Fund Corner

Upcoming NFO’s on the Rising Market

This fund follows a value/contrarian style of investing, which endeavours to find stocks that are priced significantly lower than market. This is managed directly by Mr Shankar Naren, CIO of ICICI Prudential AMC.

This fund needs 5 – 7 years of Horizon as the value fund needs higher duration than normal equity funds

Stock of the Week

Natco Pharma

CMP – 1211

Target – 1399 ( In 12 – 18 Month’s Time Frame)

NATCO Pharma Limited (NATCO) is a vertically integrated research and development focused on niche opportunities in the US.

Company is focused on high-barrier-to-entry products

Natco Pharma is a NIL Debt Company

With a growth in Net Profit of 81.62%, the company declared Very Positive results in Mar 24

With ROE of 23.7, it has a Very Attractive valuation with a 3.3 Price to Book Value

Natco Pharma has High Institutional Holdings at 25.84%

The company has declared positive results for the last 5 consecutive quarters

NET SALES(HY) At Rs 1,826.90 cr has Grown at 31.39 %

ROCE(HY) Highest at 27.20 %

For your Equity recommendation – open a De Mat account with Angel Broking with this link

https://app.aliceblueonline.com/openAccount.aspx?C=SSP03

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Click here to purchase the book from Amazon

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.