Weekly Wealth Report

Issue 167, Weekly Wealth Newsletter: 4th nov 2024 – 11th nov 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Market Outlook for Nov 2024

October saw the Indian equity markets go under a correction. This is due to record outflows from India markets.

FPI’s sells Rs 94,000 Cr stocks in Oct 2024, due to elevated stock valuations in India and attractive valuations in China.

In the near term all eyes are on US elections and Federal reserve move on rate cuts. It is widely expected that fed will cut the rates for second consecutive time.

Next 1 month will be a volatile. Next 1 Year will be bottom-up stock Market, Sector Rotation and Stock Picking is the key. Next 3 Year is a Bullish Market.

Indian economy & stock market is well supported by Government Policies, Strong Micro and Macro Fundamentals that will continue to drive corporate capex corporate earnings & GDP.

Valuations in large cap is reasonable and fair, while the valuation for Mid and Small Caps remain elevated.

Successful investment strategy requires regular reviewing and investor should buy funds at lower levels you can always reach us @ 78100 79946 for your portfolio review and rebalance

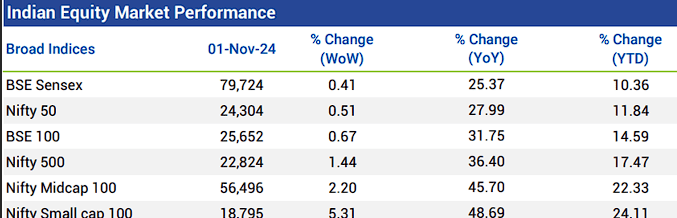

Weekly Market Pulse

Today ( 4th Nov ) Sensex Crash 1,100 pts, Nifty falls below 24,000; realty, media, oil & gas worst hit

Domestic equity markets experienced gains during last week as concerns regarding tensions in the Middle East subsided.

A notable drop in global crude oil prices on international markets has positively influenced market sentiment and furthermore gains were extended on Muhurat trading session of Samvat 2081 due to buying across the sectors.

BSE IT fell 2.91% as significant selling pressure was witnessed among the information technology stocks after a major global IT company reduced guidance.

However, persistent selling by foreign portfolio investors in domestic equity markets restricted the gains. Additionally, a cautious undertone prevailed ahead of the U.S. presidential election 2024.

On the BSE sectoral front, BSE capital goods rose 4.74% following a rebound in core sector data of Sep 2024 and government spending.

Mutual Fund Corner

Invesco India Large & Mid Cap Fund

What you need is a fund that offers Expertise and Flexibility – navigating through market movements with the aim to capture opportunities in both Large & Mid cap Segments and help you build long term wealth.

Why to invest in Invesco Large & Mid Cap Fund

- Top Quartile Large & Mid Cap Fund for 2024

- This fund pursues opportunities & flexible in both Large & Mid Cap Categories, where the valuation is fair with current market scenario.

- Facilitates longevity of stock ownership as the fund does not have to rebalance portfolio due to market cap changes

- Diversification helps to generate consistent outcomes over long term while lowering risk

- Invest in both Growth and Value Models

- Bottom Up Approach in Stock Selection

- No Cash Calls ( Fully Invested – uptp 95% )

- 50 – 70 Stocks in its portfolio

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 78100 79946 )

Stock of the Week

CDSL

CMP – 1558

Target – 1999 ( In 12 – 18 Month’s Time Frame)

Central Depository Services Limited is a Market Infrastructure Institution

part of the capital market structure, providing services to all market participants – exchanges, clearing corporations, depository participants (DPs), issuers and investors. It is a facilitator for holding of securities in the dematerialised form and an enabler for securities transactions.

Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 21.14%

Healthy long term growth as Net Sales has grown by an annual rate of 37.81% and Operating profit at 21.19%

High Institutional Holdings at 35.34%

Market Beating performance in long term as well as near term

The company has declared positive results for the last 5 consecutive quarters

Nil debt company

For your Equity Recommendation, Pls call us 78100 79946

This Week Media Publications

This week at Nanayam Vikatan – Gold Vs Equity Funds, which is better investment option for long term?

My Publications

My First 1 Crore Club

Are you still dreaming to achieve a net worth of ₹1 crore?

Still dreaming how to make 1crore?

Still Wondering how a salaried person/professionals can make 1cr?

To all the questions in your mind here is the potential ways to build it through Mutual Funds, Stocks and Much More…

Still dreaming how to make 1crore?

Still Wondering how a salaried person/professionals can make 1cr?

To all the questions in your mind here is the potential ways to build it through Mutual Funds, Stocks and Much More…

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.