Weekly Wealth Report

Issue 164, Weekly Wealth Newsletter: 14th oct 2024 – 21st Oct 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Hyundai IPO - Largest IPO for 2024

is set to open,

Should you invest?

India’s Second Largest Car Manufacturer, Hyundai Motor India IPO, the largest public issue in India is set to open on October 15, 2024.

Hyundai Motor India Limited will not get any offer issue proceeds raised from this IPO for any internal activities. Instead, all this will go to a promoter (parent company, Hyundai Motor Company) who sells shares in this IPO after subtracting offer-related costs and applicable taxes.

- The ROCE is the highest amongst all the peers and Price to Book Value is also reasonable

- The debt-to-equity ratio is less than 1 and is competitive meaning that the company is more reliant on equity financing.

- The current ratio is more than 1 which means that Hyundai Motors India can meet its short-term financial obligations.

Investors can park their funds for both Short Term Listing Gains and for Medium to Long Term Rewards.

This being one of the biggest IPO in the history of primary markets in India and there will be fair chance of allotments across the board.

Call us @ 78100 79946 to Handpick High Performing Funds and Stocks for your Portfolio

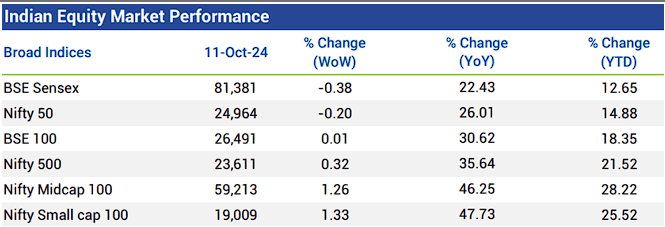

Weekly Market Pulse

- Domestic equity markets fell for the second consecutive week as key benchmark indices BSE Sensex and Nifty 50 fell 0.38% and 0.20%,respectively. However, the mid-cap segment and the small-cap segment closed the week in green

- Domestic equity markets fell amid selling in heavyweight large-cap stocks as investors turned cautious ahead of second-quarter earnings season of FY25

- Losses were extended following a rise in global crude oil prices amid escalating tensions in the Middle East due to the Israel-Iran conflict

- However, sentiment was boosted after the RBI, in its monetary policy meeting concluded on Oct 9, 2024, kept the repo rate unchanged at 6.50% for the tenth consecutive time, and shifted its stance from ‘withdrawal of accommodation’ to ‘neutral’, paving the way for potential rate cuts in the future

- On the BSE sectoral front, BSE Healthcare rose 2.02% following the recovery in the U.S. economy which remained one of the largest markets for Indian pharma companies.

- BSE Metal plunged 1.84% as China fails to introduce new stimulus measures

Mutual Fund Corner

Invesco India Flexi Cap

Equity markets are often unpredictable – economic factors, government policies, global and domestic events can cause upward and downward movements across Large, Mid and Small caps.

What you need is a fund that offers Expertise and Flexibility – navigating through market movements with the aim to capture opportunities across market caps, and help you build long term wealth.

Why to invest in Invesco Flexi Cap Fund?

1. Top Quartile Flexi Cap Fund for 2024

2. This fund pursues opportunities across the market cap range and sectors Entry and Exit at any point

3. Facilitates longevity of stock ownership as the fund does not have to rebalance portfolio due to market cap changes

4. Diversification helps to generate consistent outcomes over long term while lowering risk

Flexi Cap Investing help investor to balance both Risk and Returns

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 78100 79946 )

Stock of the Week

Bajaj Auto

CMP – 4250

Target – 5499 ( In 12 – 18 Month’s Time Frame)

- Bajaj Auto, the flagship company of Bajaj Group, is a two-wheeler and three-wheeler manufacturing company that exports to 79 countries across several countries in Latin America, Southeast Asia, and many more. Its headquarter is in Pune.

- Company is almost debt free and with Free Cash flow of 20,268 Crore.

- High Institutional Holdings at 23%

- Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 21.68%

- The company has declared positive results for the last 6 consecutive quarters

- Healthy long term growth as Net Sales has grown by an annual rate of 8.99%

- PAT (9M) At Rs 5,985.84 cr has Grown at 24.15 %

- NET SALES (HY) At Rs 23,487.02 cr has Grown at 22.07 %

- Multiple factors for the stock are Bullish like MACD, Bollinger Band and KST

For your Equity Recommendation, Pls call us 63795 18807

This Week Media Publications

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Buy Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Book Online at Low Prices in India | Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Reviews & Ratings – Amazon.in

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.