Weekly Wealth Report

Issue 163, Weekly Wealth Newsletter: 07th oct 2024 – 14th Oct 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 163, Weekly Wealth Newsletter: 07th oct 2024 – 14th Oct 2024

Where to Invest as Isreal War Escalate and Oil on the Boil?

Foreign Investors turned out Net Sellers amounting to Rs. 27,472 Crores in last 3 trading days.

October sees most outflow as Isreal – Iran war escalates

Brent crude price has rallied about 4 per cent since Iran’s attack late Tuesday. While this triggered a sell-off in major oil-linked stocks, such as those from the oil marketing, paints, aviation, and tyre sector.

From a technical viewpoint, we advise traders to adopt “sell on rise” strategy

The Middle East war may become a localised war, like the Russia-Ukraine war, with people accepting it as a ‘part of life’.

long-term investors may use this correction to buy

large-cap stocks, where valuations have become attractive.

Use these dips to buy quality Stocks & Mutual Funds for Long Term Investing.

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

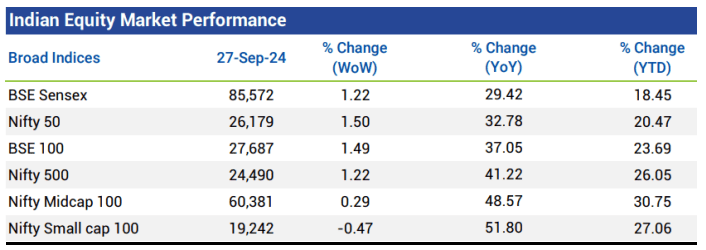

Weekly Market Pulse

- Domestic equity markets fell after witnessing rise for three consecutive weeks as key benchmark indices BSE Sensex and Nifty 50 fell 4.54% and 4.45%, respectively. The fall was broad-based as the mid-cap segment and the small-cap segment closed the week in red

- Domestic equity markets fell due to broad-based sell-off across the sectors as fears of a full-fledged war between Iran and Israel dented investors’ appetite for riskier assets on expectations of a significant retaliatory attack by Israel following Iran’s missile strikes

- Losses were extended following a spike in global crude oil prices on supply uncertainty due to geopolitical tensions in the Middle East.

- Sentiment was dampened following the SEBI’s new rules for derivatives trading, including raising the entry barrier by increasing the contract size and upfront collection of options premium.

- On the BSE sectoral front, BSE Realty fell 7.92% following a decrease in registrations of housing units in Mumbai in Sep 2024.

- BSE AUTO declined 5.94% following the sales data of Sep 2024, which pointed out that the start of the festive season for automobile companies has been weaker.

Mutual Fund Corner

ICICI Balanced Advantage Fund

ICICI Balanced Advantage Mutual Funds are deemed suitable for investors who have a low-risk appetite but want to enjoy steady returns on their investments.

This Hybrid Fund helps such investors to even out the risk that comes along with investing in just one type of asset class.

Why to consider ICICI Pru Balanced Advantage Fund?

1.Low Beta Fund

2.Ready Made Portfolio with Automatic Asset Allocation & Rebalancing

3.Entry and Exit at any point

The purpose of these funds is to enhance and diversify an investment portfolio through Auto Asset Allocation across Debt & Equity. This will ensure your portfolio yield reasonable returns with very low volatility. Investors who wish to participate in equity markets with relatively conservative approach can invest in this scheme

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 6379518807 )

Stock of the Week

TCS

CMP – 4250

Target – 5499 ( In 12 – 18 Month’s Time Frame)

- Tata Consultancy Services is the flagship company and a part of Tata group. It is an IT services, consulting and business solutions organization that has been partnering with many of the world’s largest businesses in their transformation journeys for over 50 years.

- Company is almost debt free.

- Company has a good return on equity (ROE) track record: 3 Years ROE 47.4%

- High Institutional Holdings at 23%

- Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 40.36%

- The company has declared positive results for the last 6 consecutive quarters

- Healthy long term growth as Net Sales has grown by an annual rate of 10.18%

- Tech Companies are Safe Bets and Defensive Stocks when the Stock Market is on the boil.

For your Equity Recommendation, Pls call us 63795 18807

This Week Media Publications

This week at Nanayam Vikatan – 5 Golden Rule to Exit Share and book profit

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Buy Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Book Online at Low Prices in India | Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Reviews & Ratings – Amazon.in

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.