Weekly Wealth Report

Issue 162, Weekly Wealth Newsletter: 30th Sep 2024 – 7th Oct 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 162, Weekly Wealth Newsletter: 30th Sep 2024 – 7th Oct 2024

Are we Heading for Deep Correction?

Are we in a Stock Bubble Market?

Fear and Greed are the two dominant emotions, keep coming along when the Stock Market is at 52 Week high.

Many investors thinks that this unstoppable Bull Rally might be a Bubble Market. Many thinks that the Stock Market can even go down by 30% from Current Levels.

- Stock Market is like a pendulum and it is normal even if it falls by 5%.

- Historically market corrected more than 30% when Indian Current Account Deficit is more than 4.5%. Currently it is lesser than 1%, well under control.

- Inflation, Fiscal Deficit and External Debt are all under control

- Indian Stock Market is not in Bubble Market, it is a Long Term Trendline Market.

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

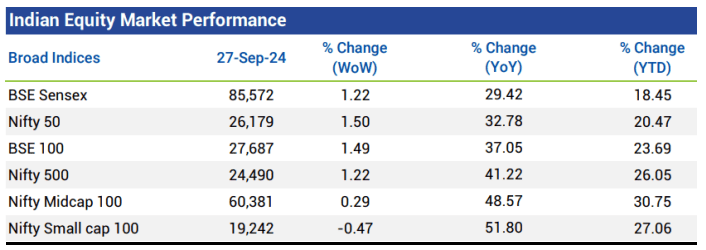

Weekly Market Pulse

- Domestic equity markets rose for the third consecutive week as key benchmark indices BSE Sensex and Nifty 50 rose 1.22% and 1.50%, respectively. The mid-cap segment closed the week in green, however, the small-cap segment closed the week in red.

- Domestic equity markets rose following weak U.S. economic data that bolstered the case for deeper rate cuts by the Federal Reserve in the next meeting, which is due in Nov 2024.

- The influx of retail investors, the robustness of India’s economic expansion, and increasing optimism regarding the possible initiation of a rate-cutting cycle have propelled the market upward.

- Gains were extended following a sharp drop in global crude oil prices after reports emerged that the OPEC member Saudi Arabia was prepared to pump more oil to regain market share.

- On the BSE sectoral front, BSE Metal rallied 7.11% after the People’s Bank of China cut the reserve requirement ratio for banks by 50 bps and lowered key interest rate to support the country’s faltering economy.

Mutual Fund Corner

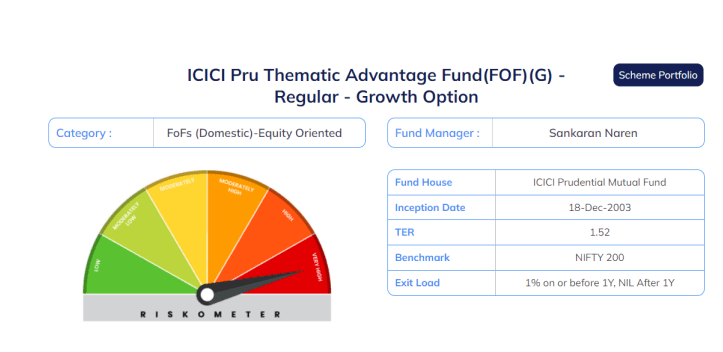

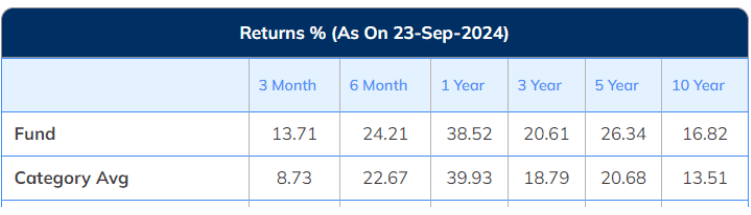

ICICI Thematic Advantage Fund

The primary objective of the Scheme is to generate capital appreciation primarily from a portfolio of Sectoral / Thematic schemes accessed through the diversified investment styles of underlying schemes. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved.

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 6379518807 )

Stock of the Week

HDFC Bank

CMP – 1728

Target – 2199 ( In 12 – 18 Month’s Time Frame)

As of April 2024, HDFC Bank has a market capitalization of $145 billion, making it the third-largest company on the Indian stock exchanges.

It is India’s largest private sector bank by assets and the world’s tenth-largest bank by market capitalization as of May 2024.

Strong Long Term Fundamental Strength with an average Return on Assets (ROA) of 1.75%

With a growth in Interest of 50.31%, the company declared Very Positive results in Jun 24

With ROA of 1.8, it has a Fair valuation with a 2.9 Price to Book Value, The company has declared positive results for the last 6 consecutive quarters

HDFC Bank has Highest Institution Holding of 82%

Multiple factors for the stock are Bullish like MACD, Bollinger Band, KST and DOW

For your Equity Recommendation, Pls call us 63795 18807

This Week Media Publications

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Buy Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Book Online at Low Prices in India | Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Reviews & Ratings – Amazon.in

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.