Weekly Wealth Report

Issue 161, Weekly Wealth Newsletter: 23rd Sep 2024 – 30th Sept 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 161, Weekly Wealth Newsletter: 23rd Sep 2024 – 30th Sep 2024

What could push

Indian Stock Market in Long Run?

India’s equity market has been on a relentless bull run since the pandemic, but recent lacklustre earnings and slowing GDP growth may mean stocks take a pause? Can India Bull Run Sustain?

Indian equity markets scaled new all-time highs this year and apart from a period of volatility around the time of the general election, its stocks have consistently outperformed Emerging Market (EM) peers.

• India’s GDP is expected to grow at a rate of 6.1% over the next five years, making it the world’s third-largest economy by 2027.

• Manufacturing and exports are key to the next wave of economic growth in India.

• Sectors such as electronic manufacturing, power and infrastructure are set to gain from India’s push to become a top beneficiary of supply chain relocation.

India has become one of the fastest growing economies in the world, with real GDP set to grow by 6.5% in 2024.

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

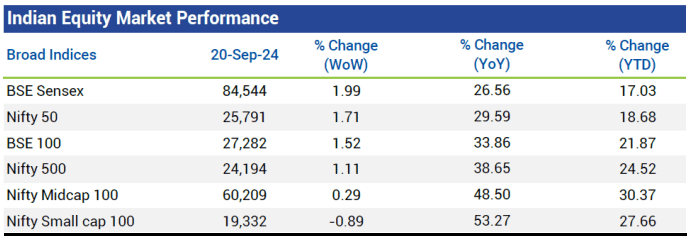

Weekly Market Pulse

- Domestic equity markets rose for the second consecutive week as key benchmark indices BSE Sensex and Nifty 50 rose 1.99% and 1.71%, respectively. The mid-cap segment closed the week in green, however, the small-cap segment closed the week in red.

- Domestic equity markets rose during the week as investors reacted positively to the U.S. Federal Reserve’s decision to cut interest rate by 50 bps, signalling further easing in coming months to keep the labor market from slowing too much.

- Markets reached fresh highs on expectations of inflow of foreign funds into domestic equity markets following the big interest rate cut by the U.S. central bank.

- However, markets witnessed some profit booking at higher levels amid signs of escalating tensions in the Middle East.

- On the BSE sectoral front, BSE Realty, BSE Bankex & BSE AUTO gained 4.67%, 3.47% & 2.30%, respectively, as investors responded favourably to these rate-sensitive sectors following the U.S. Federal Reserve’s decision to reduce the interest rate significantly by 50 bps, marking the

first decrease in borrowing costs since Mar 2020.

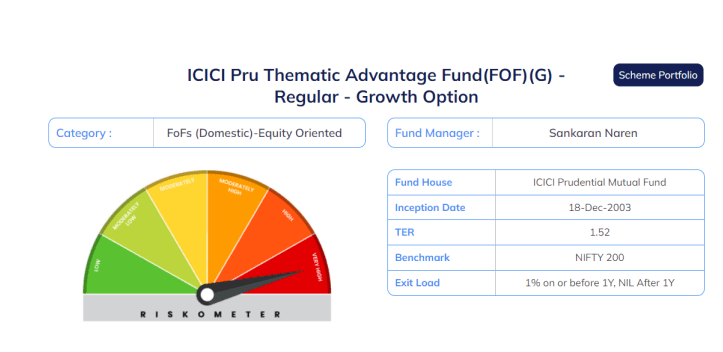

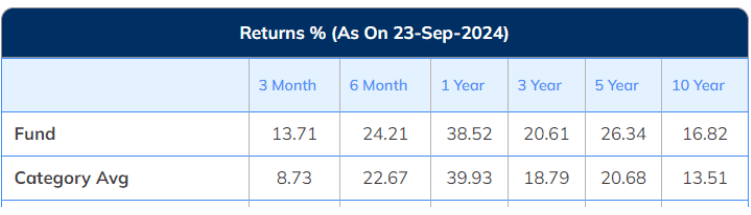

Mutual Fund Corner

ICICI Thematic Advantage Fund

The primary objective of the Scheme is to generate capital appreciation primarily from a portfolio of Sectoral / Thematic schemes accessed through the diversified investment styles of underlying schemes. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved.

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 6379518807 )

Stock of the Week

HDFC Bank

CMP – 1755

Target – 2199 ( In 12 – 18 Month’s Time Frame)

As of April 2024, HDFC Bank has a market capitalization of $145 billion, making it the third-largest company on the Indian stock exchanges.

It is India’s largest private sector bank by assets and the world’s tenth-largest bank by market capitalization as of May 2024.

Strong Long Term Fundamental Strength with an average Return on Assets (ROA) of 1.75%

With a growth in Interest of 50.31%, the company declared Very Positive results in Jun 24

With ROA of 1.8, it has a Fair valuation with a 2.9 Price to Book Value, The company has declared positive results for the last 6 consecutive quarters

HDFC Bank has Highest Institution Holding of 82%

Multiple factors for the stock are Bullish like MACD, Bollinger Band, KST and DOW

For your Equity Recommendation, Pls call us 63795 18807

This Week Media Publications

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Buy Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Book Online at Low Prices in India | Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Reviews & Ratings – Amazon.in

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.