Weekly Wealth Report

Issue 155, Weekly Wealth Newsletter: 12th Aug 2024 – 19th Aug 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 155, Weekly Wealth Newsletter: 12th Aug 2024 – 19th Aug 2024

What is Fresh Allegation from Hindenburg, Will it impact Stock Market?

Hindenburg opens a fresh can of worms, with fresh allegation against SEBI Chief, Madhabi Puri Buch.

When most of us thought Hindenburg and Adani controversy was over, Hindenburg which makes money in short selling of shares and bonds, targets SEBI Chief and her husband had a stake in offshore funds, which invest in Adani Group.

In Short

- Hindenburg pushes back against Sebi chief’s claims of no wrongdoing

- Alleges conflicts of interest tied to Adani Group

- Questions transparency of Madhabi Buch’s consulting firms

Though SEBI Chief and Adani Group denies that any commercial relationship, this is a developing news.

Market players feel that this Report is not big negative for Dalal Street, the Shock Value is not as big as its first report. Negative factors like Geopolitical issues or volatile global market can impact the market than Hindenburg Report.

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

Weekly Market Pulse

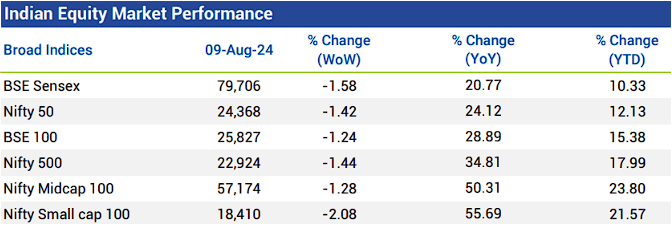

Domestic equity markets fell for the second consecutive week as key benchmark indices BSE Sensex and Nifty 50 fell 1.58% and 1.42%, respectively. The fall was broad-based as the midcap segment and the small-cap segment closed the week in red.

Domestic equity markets fell during the week on concerns over a potential economic slowdown in the U.S. because of lack lustre economic indicators such as sluggish job growth, increased unemployment rates, and disappointing corporate profits.

Losses were extended due to Yen carry trade issue following the Bank of Japan’s decision to raise its interest rate from 0.1% to 0.25%.

Markets fell further after the RBI maintained a status quo on policy rates and stance amid concerns over elevated food inflation in its latest monetary policy concluded on Aug 8, 2024.

However, losses were restricted after U.S. Labor Department data showed that first-time jobless benefits claims stood at 2,33,000 as of Aug 3, 2024, down by 17,000 from Jul 27, 2024, which alleviated the concerns about a potential slowdown in the U.S. economy.

Mutual Fund Corner

ICICI Multi Asset Fund

The multi-asset allocation Mutual Funds are deemed suitable for investors who have a low-risk appetite but want to enjoy steady returns on their investments.

The multi-asset allocation helps such investors to even out the risk that comes along with investing in just one type of asset class.

Additionally, it ensures a steady flow of income for the investors even at a time when some asset classes are underperforming than usual.

Why to consider ICICI Pru Multi Asset Fund?

1.Diversification

2.Ready Made Portfolio with Asset Allocation

3.Entry and Exit at any point

4.Automatic Rebalancing from Fund Manager

The purpose of these funds is to enhance and diversify an investment portfolio through multi-asset allocation across several asset classes. Through such an action, the fund further aims at cushioning the risks that are associated with investing in just one class of asset.

To invest in SIP & in Mutual Funds Click the link and start your investments instantly ( You can also call us @ 7810079946 )

Stock of the Week

CDSL

CMP – 2565

Target – 2999 ( In 6 – 12 Month’s Time Frame)

- Central Depository Services Limited is a Market Infrastructure Institution (MII), part of the capital market structure, providing services to all market participants – exchanges, clearing corporations, depository participants (DPs), issuers and investors.

- Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 21.14%

- Healthy long term growth as Net Sales has grown by an annual rate of 34.48% and Operating profit at 21.19%

- High Institutional Holdings at 38.9%

- With a growth in Net Profit of 78.66%, the company declared Outstanding results in Jun 24

- The company has declared positive results for the last 4 consecutive quarters

- NET SALES(Q) Highest at Rs 257.39 cr

For your Equity recommendation – open a De Mat account with Angel Broking with this link

This Week Media Publications

How Fund Managers picks up High Performing Stocks from Stock market, Join me LIVE Stock picking online Course @ Rs. 999/-

Link above to sign up the live webinar on untold the stock picking secrets!

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Buy Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Book Online at Low Prices in India | Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Reviews & Ratings – Amazon.in

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.