Weekly Wealth Report

1st July 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 149, Weekly Wealth Newsletter: 1st

July 2024 – 8th July 2024

FII Turns Net Buyers in June 2024,

Is this the Biggest Bull Run in Stock Market?

Bulls on charge Sensex nearing 80,000 and Nifty crossed 24,000. Looking ahead the attention will gradually shift towards Union Budget and Q1 Earnings for Financial Year 25.

On Investing Mark Mobius said “You always have to keep in mind that the best way is to get the value is to do what other people is not doing”

Mark Mobius, Billionaire Investor, said that he is confident that the bull run in Indian stock markets is intact. Sensex can even hit the 1 lakh mark before PM Modi finishes his third term and Sensex to grow at a pace of 15% over next 10 Years.

Don’t miss out on this opportunity to ride this wave.

Call us @ 78100 79946 to start your Investments

Weekly Market Update

-

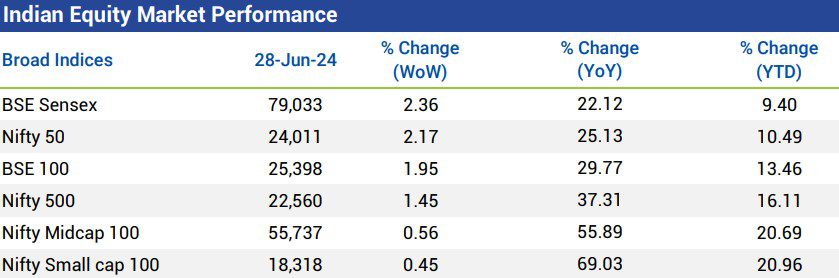

- Domestic equity markets rose for the fourth consecutive week as key benchmark indices BSE Sensex and Nifty 50 rose 2.36% and 2.17%, respectively. The rally was broad-based, as the mid-cap segment and the small-cap segment also closed the week in green.

-

- Domestic equity markets rose during the week as investors’ sentiment was underpinned after the central bank data showed that India’s current account balance recorded a surplus of $5.7 billion or 0.6% of GDP in Q4 FY24, driven by a lower merchandise trade deficit.

-

- Meanwhile, markets key benchmark indices progressed to hit fresh milestones supported by information technology and energy stocks.

-

- However, gains were capped due to profit booking ahead the release of the U.S. personal consumption expenditure inflation data of May 2024, which will provide more clarity on interest rate trajectory by the U.S. Federal Reserve. Rising global crude oil prices also restricted the gains.

-

- On the BSE sectoral front, BSE IT rose 2.15% on expectation of revival in the information technology sector following its U.S. peers. Oil & gas shares also witnessed demand as BSE Oil & Gas rose 2.11%.

Mutual Fund Corner

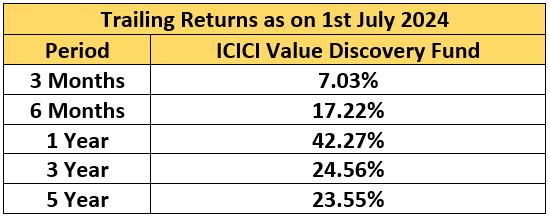

ICICI Value Discovery Fund

This fund follows a value/contrarian style of investing, which endeavours to find stocks that are priced significantly lower than market. This is managed directly by Mr Shankar Naren, CIO of ICICI Prudential AMC.

This fund needs 5 – 7 years of Horizon as the value fund needs higher duration than normal equity funds

Stock of the Week

HDFC Bank

CMP – 1696

Target – 1999 ( In 12 – 18 Month’s Time Frame)

For your Equity recommendation – open a De Mat account with Angel Broking with this link

https://app.aliceblueonline.com/openAccount.aspx?C=SSP03

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Click here to purchase the book from Amazon

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.