Weekly Wealth Report

24th June 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 148, Weekly Wealth Newsletter: 24th June 2024 – 1st July 2024

Fastest Growing AMC “Quant” is facing SEBI Inquiry,

What an investor should do now?

Quant is one of the fastest growing Asset Management Company with 90,000 Crore of AUM. SEBI has conducted raids at Mumbai Head Quarters and suspected beneficial ownership in Hyderabad on the grounds of Front Running activity.

Front running (in the current context) is when a fund manager and their associates buy shares in their personal account(s) before a fund purchases the shares. Since the fund would place a large order, the price will move up. So, the employees would get an immediate gain that can be sold off. Naturally, this is illegal and unethical and is banned by SEBI.

We advise against any knee-jerk reactions, such as redemptions, until there is more clarity from the regulator or the mutual fund company.

It's important to note that, unlike individual stocks that may experience significant drops in response to such news, mutual fund investors are generally not impacted in the same way since mutual funds are essentially pass-through vehicles. The current investigation appears to pertain to the fund management process, not the stock portfolio of the funds being managed by the Asset Management Company (AMC).

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

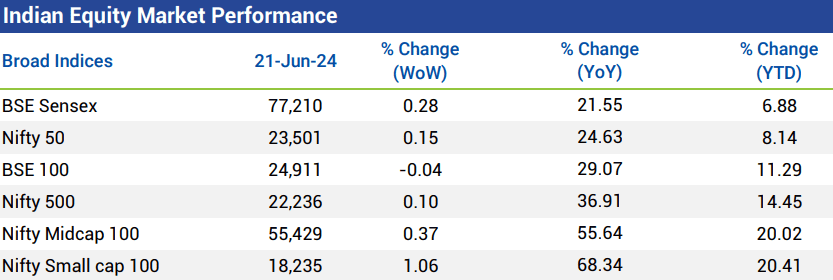

Weekly Market Update

-

- Domestic equity markets rose for the third consecutive week as key benchmark indices BSE Sensex and Nifty 50 rose 0.28% and 0.15%, respectively. The rally was broad-based, as the mid-cap segment and the small-cap segment also closed the week in green.

-

- Domestic equity markets reached a fresh high supported by a favourable view of the overall domestic economy, along with the hope for a prosperous rainy season.

-

- Gains were extended after the Swiss National Bank delivered another interest rate cut, reducing its policy rate by 25 bps to 1.25%.

-

- Investors’ focus remained on the upcoming Union budget along with progress of the monsoon for further cues.

-

- On the BSE sectoral front, BSE Bankex rose 3.22% led by private sector banks due to ‘valuation comfort’ over public sector banks and the return of foreign money.

-

- BSE IT increased 1.88% after a major U.S. based information technology firm provided a positive annual revenue growth forecast, indicating demand in the crucial U.S. marketplace

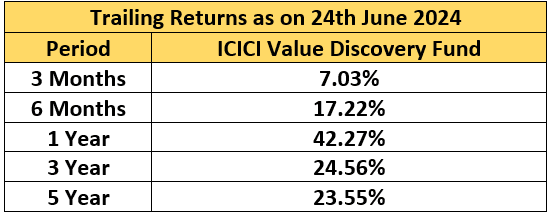

Mutual Fund Corner

ICICI Value Discovery Fund

This fund follows a value/contrarian style of investing, which endeavours to find stocks that are priced significantly lower than market. This is managed directly by Mr Shankar Naren, CIO of ICICI Prudential AMC.

This fund needs 5 – 7 years of Horizon as the value fund needs higher duration than normal equity funds

Stock of the Week

HDFC Bank

CMP – 1662

Target – 1999 ( In 12 – 18 Month’s Time Frame)

For your Equity recommendation – open a De Mat account with Angel Broking with this link

https://app.aliceblueonline.com/openAccount.aspx?C=SSP03

This week Media Publications

This week at Nanayam Vikatan – Should you switch your Mutual Fund Schemes frequently for High Returns?

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Click here to purchase the book from Amazon

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.