What an investor should do when the country fights the corona virus and protecting the citizen through lock downs. When most of the economic activity has stopped and the current situation has taken a toll on the lives like Job Losses, variable pay & Salary cut, practice these hacks to navigate this hardship and tide over situation with lesser pain.

Handle the cash with Care

Cash is King. Try to be frugal with cash with no Malls, Cinema, Entertainment, Eating out etc. Be mindful when you spend your resources. Remember when you do the underwater swimming the utilisation of oxygen is very important if you want to swim longer, it is better to preserve your oxygen. Here the oxygen is Cash, remember go frugal and spend only on essentials. It’s the time to identify and differentiate between Want Vs Need.

Prepare for pay cut or Variable pay

Don’t complain on the current situation. When you are prepared for the worst, it is easier to recover and act. The quicker we adapt to this new norms, the easier for us to take decisions and move on. Cash flow is a problem for both employer and employees.

Managing your existing debts

Try not to add new debts on this situation. It is not the home loan that put you in the problem. The credit issues always revolve around with unpaid credit card outstanding and personal loans. If you have too many high cost debts to be serviced, you can even consider liquidating some of your assets and pay off your high interest loans.

Upgrade your skills to stay ahead

Look ways to learn new skills online and remember this – Old ways never bring higher profits. Pick up some skills which can compliment to your job and current line of work. This might open some new opportunity in and outside of your current job.

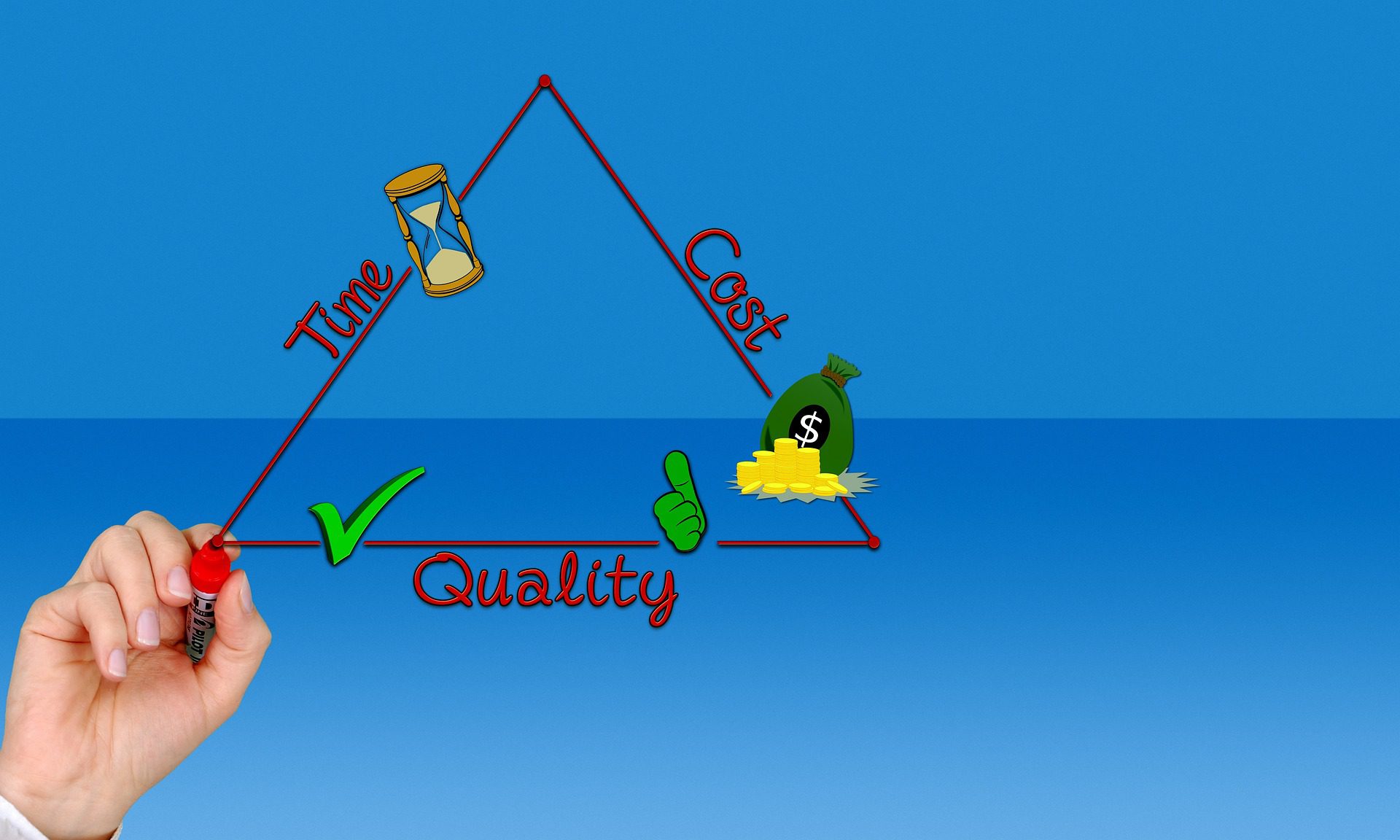

Review your Asset today

The difference between a Rich & Successful person and ordinary person is knowing what you own. Categorise your assets into Fixed Income, Gold, Financial Assets and Real Estate. Check your asset allocation and diversification of your assets. Analyse and observe that whether you need to alter or your portfolio is matching the model portfolio and finally – Review your Money principles

- Check whether you have sufficient Health Insurance and Term Insurance for yourself.

- Try not to opt for Moratorium

- Set aside & review you have Emergency cash for 6 Months

Call me to review your existing portfolio @ 9841058689

Click here to take advantage of this situation and make your investments

http://www.assetplus.in/partner/sathishkumar

One Call Can Change your Finance Forever

Take Your First Step Towards Smarter Investment Decision.

Sathish Kumar

Equity Fund Manager | Wealth Consultant | Author

Whatsapp / Call – +91 9841058689

http://sathishspeaks.com/

Kickstart your Investment Journey of 2025 from here🤝🏻

Check out Our New Course “Welcome to the World of Mutual Funds”🙌

You will Learn:

1.A-Z of Mutual Funds

2.SIP Techniques & Much More

You will get:

1.8 Chapters

2.Recorded Course

3.Lifetime Access

Actual Cost 4999/- and get it for 2499/-

For First 100 Registrations as Launch Offer Buy it at 1999/-

Use Code “SATHISHSPEAKS2025” Hurry Up Limited Period Offer Only!!!!

Click the below link to enroll to the course and Transform your

finances 👇

https://webinar.sathishspeaks.com/