Weekly Wealth Report

Issue 160, Weekly Wealth Newsletter: 16th Sep 2024 – 23rd Sept 2024

(Weekly Wealth Newsletter and a Private Circulation from Creating Wealth Company)

Curated by

Mr. Sathish Kumar

Founder – Creating Wealth Company

Crorepathi Creator | Financial Consultant | Author | Speaker | Columnist | Youtuber

Phone – 9841058689

Mail – creatingwealthadvisory@gmail.com

Web – www.sathishspeaks.com

Issue 160, Weekly Wealth Newsletter: 16th Sep 2024 – 23rd Sep 2024

4 News Headlines that can change Stock Market Direction

When Domestic Equity Markets are at all time high, Sensex crossing 83,000. These are the 4 News Headlines that can decide and change the direction of the Stock market.

1. Dalal Street Investors awaiting US Fed Reserve Sep 18th meeting which could decide the direction of the stock market around the world. While it is almost given that the US fed will reduce the Interest rate, the quantum of reduction could be the deciding Factor.

2. 50 BPS cut could spart a positive reaction especially in emerging markets like India. However there are also concerns about the underlying Strength and other Indicators from US Market.

3. Listing of Bajaj Housing Finance will set the sentiment for upcoming IPO segments ( Like PN Gadgil Jewellers and others IPO ) in Indian Stock Market

4. Indian Investors are also awaiting WPI ( Whole Sale Price Index ) Numbers which is due this week.

Call us @ 63795 18807 to Handpick High Performing Funds and Stocks for your Portfolio

Weekly Market Pulse

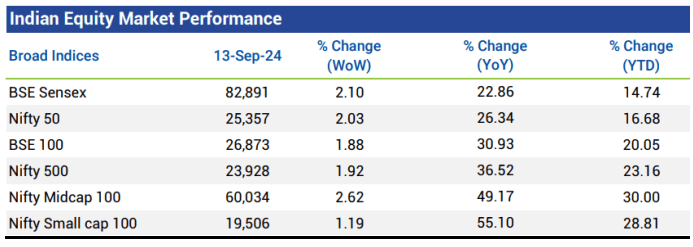

- Domestic equity markets rose after witnessing a fall in the previous week as key benchmark indices BSE Sensex and Nifty 50 rose 2.10% and 2.03%, respectively. The rally was broad based as the mid-cap

segment and the small-cap segment closed the week in green. - Domestic equity markets rose during the week amid hopes of a potential rate cut by the U.S. Federal Reserve on Sep 18, 2024, following comfortable U.S. CPI data of Aug 2024 which increased by

0.20% on monthly basis. - Gains were extended following the news that China is expected to cut rates by 50 bps on $5 trillion mortgages later this month to boost demand in real estate and commodity markets.

- On the BSE sectoral front, BSE consumer durables gained 4.50% ahead of the festive season on expectations of an increase in consumer spending on durable goods like electronics and home appliances.

- Jewellery stocks also witnessed significant rise as gold reached record highs on expectation of rate cuts by the central banks amid easing inflation.

Mutual Fund Corner

Edelweiss Business Cycle Fund

The Edelweiss Business Cycle Fund evaluates businesses combining Momentum with Value ( PE, PB, EBITDA, Div Yield ) Quality ( ROE, ROCE) and Growth ( EPS, Operating Margin )

This fund invest in a factor-based approach to capture trends in business cycles.

Why to consider Edelweiss Business Cycle Fund?

1. Filter from top 300 stocks by market cap for investable universe.

2. Market-cap bias – Aims to maintain equal allocation between large caps and mid/small caps.

3. Key factors used in the model – Growth, Quality, Value & Momentum.

4. Construct portfolio of 60 stocks across large cap and mid/small cap universe.

5. Select top ranked stocks from each factor combination based on their scores

(Value+Momentum; Growth+Momentum; Quality+Momentum)

To invest in SIP & in Mutual Funds Click the link and start your investments instantly

( You can also call us @ 7810079946 )

Stock of the Week

TCS

CMP – 4510

Target – 5499 ( In 12 – 18 Month’s Time Frame)

Tata Consultancy Services is the flagship company and a part of Tata group. It is an IT services, consulting and business solutions organization that has been partnering with many of the world’s largest businesses in their transformation journeys for over 50 years.

Company is almost debt free.

Company has a good return on equity (ROE) track record: 3 Years ROE 47.4%

High Institutional Holdings at 23%

Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 40.36%

The company has declared positive results for the last 6 consecutive quarters

Healthy long term growth as Net Sales has grown by an annual rate of 10.18%

Multiple factors for the stock are Bullish like MACD, Bollinger Band, KST and DOW

For your Equity recommendation – open a De Mat account with Alice Blue with this link

This Week Media Publications

Middle Class to Million Dollar Book

Man and his struggle to generate and preserve wealth is eternal. One thing which is common among everyone in this society, that everyone has financial dream and aspiration to become Crorepati.

Middle Class to Million Dollar is a guide to understand how simple and common sense in Personal Finance can help you to get wealthy Corpus.

Buy Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Book Online at Low Prices in India | Middle Class to Million Dollar / மிடில் கிளாஸ் முதல் மில்லியன் டாலர் வரை Reviews & Ratings – Amazon.in

To Buy my Untold Wealth Secret Book from Flipkart

This Newsletter is from Creating Wealth Company – For Private Circulation only.

For more information connect with Sathish Kumar @ 9841058689

You can also connect with us investments@sathishspeaks.com

Visit – www.sathishspeaks.com for More Details.

Disclaimer

Mutual Funds and Stock Market Investments are subject to market risks, pls read all scheme-related documents carefully. The past performance of the mutual fund is not necessarily indicative of future performances. Mutual fund does not guarantee any returns or dividends.

This report is for informational purposes only and contains information, opinions, and material obtained from reliable sources every effort has been made to avoid errors and omissions and is not to be construed as advice or an offer to act on views expressed therein or an offer to buy and/or sell any securities or related financial instruments, we shall not be responsible and/or liable to anyone for any direct or consequential use of the contents thereof. Reproduction of the contents of this report in any form or by any means is prohibited.