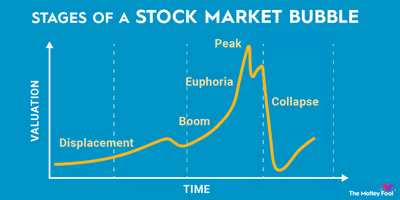

The No 1 Question is whether you should apply brake in equity market due to excessive rally and high valuations.

Strategy 1

Sharp rally in the last five months made most of the portfolio overshot on the limits in your equity. Keep the Portfolio Re balanced to your pre determined allocation. This will help to book profits and reduce your risk if the market corrects. The impact in your portfolio will be low and you can still switch if the markets goes down.

Review your portfolio always as every quarter. Rebalancing your portfolio may help you to adjust your sail if the market nose dives

Keep exit load and your tax obligations in your mind when you do rebalancing your portfolio.

Strategy 2

STP is the time tested way to participate in volatile market. When the market goes up or down, your money is always protected and get appreciated.

If it is a lump sum, take the STP route. You can even convert your high risk equity to liquid funds and initiate a STP.

You can even reduce your equity participation and play safe it with switching it to debt fund or dynamic asset allocation fund.

The fears of a market correction given these valuations are real and it may be time for you to get more involved in managing your portfolio.

Consult an adviser to focus on what you can control instead of getting influenced by the state of the economy and the markets which you can’t predict.

Take Your First Step Towards Smarter Investment Decision.

Helping people to Increase their Net worth and Wealth.